Since tonight is the Truth in Taxation public hearing (the Journal Star has a good article on this by John Sharp), let’s talk about taxes.

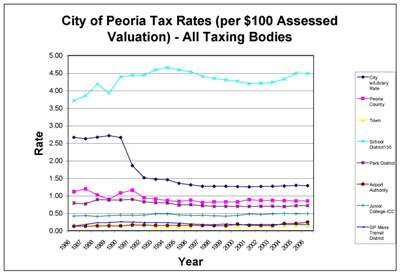

Here’s an interesting chart that I got from City Manager Randy Oliver. It shows a comparison of property tax rates from 1986-2006. The dark blue line is the City of Peoria’s tax rate (you can click on the graph to look at a larger image of it):

Now the question is, what conclusions should we draw from this raw data?

Well, the thing that jumps out at you first is the precipitous drop in the city’s property tax rate around 1991-1992. I’d like to know what caused that. Did the city cut its budget that much that year? Or did they just shift the revenue source to something else, like motor fuel taxes or utility taxes? I’ve written a couple of people at the city with these questions, but they haven’t found an answer yet (any of my long-time-Peoria-resident readers happen to recall?).

Here are some other numbers to consider while comparing the tax rate over the past 20 years:

|

1986 |

2006 |

Difference |

| Population |

117,766 |

112,936 |

-4,830 |

| Total Area |

41.02 mi.2 |

48.13 mi.2 |

+7.11 mi.2 |

| EAV |

$733,041,040 |

$1,623,388,425 |

+$890,347,385 |

Tax Rate

per $100 EAV |

2.6596 |

1.2879 |

1.3717 |

Tax Receipts

excl. TIFs |

$13,036,924 |

$21,336,394 |

+$8,299,470 |

Interesting stuff, isn’t it? Even though the tax rate dropped by more than half between 1986 and 2006, revenue increased by more than 63% (or an average of roughly 3% per year). For most of the past 20 years, the city has locked down the tax rate and lived off the increase in Equalized Assessed Value (EAV). But can that go on forever?

The people I’ve talked to, including the city’s finance director, say no. In fact, adjusted for inflation, the tax receipts have actually gone down over the last 20 years. That $13 million in 1986 equals $23.98 million in 2006 dollars (according to this calculator).

A recent article in the National Cities Newspaper titled, “City Finances Okay for Now; Storm Clouds Ahead” (10/22/2007) warns about the near future:

“The picture for 2008 is less optimistic with city officials predicting a slowdown in revenues and increased spending pressures. Concerns about the health of real estate markets and their potential impacts on property taxes, combined with increased calls for property tax relief from homeowners and residents, will cloud the picture in 2008. Health care and pension costs, in particular, are increasing at a faster rate than city revenues.”

So what’s a city to do? People don’t want their property taxes to go up, but the city has obligations that it can’t just cut (e.g., basic services, health care/benefits for city employees, the combined sewer overflow project, etc.). And the rise in EAV obviously isn’t cutting it. That’s why we have the garbage tax. And the HRA tax. And sales tax. And the fuel tax. And a plethora of other taxes. These are new revenue streams that were created so the council could get the money the city needs and claim they “held the line on taxes.”

But that’s not really true, is it? Taxes are going up. Property tax revenues are going up because of increasing EAV, even if the tax rate remains the same. And in addition, other taxes are being raised and/or created to fill the gap that remains. So, we’re only fooling ourselves by insisting that property taxes remain low. We’re not saving any money or paying any less in taxes. The city’s still getting their money through other means.

So I think the real question we have to ask ourselves is, what’s the fairest way to raise revenue for the city? For example, is it fairer to put a $6 surcharge on water bills (a regressive tax), or to raise property taxes (a progressive tax)? Are these new revenue streams a bigger burden on the poor?