From the Journal Star:

With little debate, the Illinois Senate today voted 51-4 to send Gov. Rod Blagojevich a proposal to let Peoria County ask voters to OK a special sales tax to help pay for the Peoria riverfront museum.

The legislation, Senate Bill 1290, passed earlier in the House of Representatives. With Blagojevich’s signature, it would become law, and the question could be put to voters in the February or April municipal elections.

Not mentioned in the article is the fact that the bill allows increases in 1/4% increments, and could be used toward any “public facility” (e.g., Belwood Nursing Home), not just the museum. The way it will likely read on the ballot is:

To pay for public facility purposes, shall Peoria County be authorized to impose an increase on its share of local sales taxes by .25% (.0025) for a period not to exceed (insert number of years)?

This would mean that a consumer would pay an additional 25¢ ($0.25) in sales tax for every $100 of tangible personal property bought at retail. If imposed, the additional tax would cease being collected at the end of (insert number of years), if not terminated earlier by a vote of the county board.”

A quarter of a percent increase doesn’t sound like a whole lot, does it? But consider that, if this referendum were to pass, you would be paying .25% more on things that already are highly taxed — like restaurant food (which would go from 10% to 10.25% in the city). Is that going to make Peoria more or less competitive than East Peoria, right across the river? How many people do you think will come to see the museum in Peoria, then go have lunch in East Peoria?

And what about the economy? Is this the time to be increasing taxes when there’s plenty of unemployed people? What is the city’s solution on how to decrease the unemployment rate?

Consider these other items in the news as of late:

- “[T]he effects of the economic crisis are being felt beyond Wall Street as charities locally and nationwide report increases in basic needs and decreases in donations to provide those. Some of the people who used to be donors are now asking for donations…. Nearly 90 percent of Catholic Charities nationwide report more families seeking help, with senior citizens, the middle class and the working poor among those hit hardest by the downturn…. The Salvation Army already has seen between 15 percent and 20 percent more need than last year in its first week of assistance applications received for the holidays…. The Friendship House scaled back the number of families this year allowed into their Adopt-A-Family program to ensure they could fulfill the need.”

- “Fiscal restraint was the guiding principle in crafting next year’s [Peoria] county budget, which represents a 6 percent overall decrease over last year’s budget. In what is being described as a ‘maintenance budget’ with no new taxes or fees and no spending cuts, preliminary figures show spending requests at nearly $122 million while the county expects to bring in about $119 million in revenues. The approximately $3 million deficit – mostly in the capital fund – will be covered by reserve funds that sit at nearly $74 million, said Erik Bush, Peoria County’s chief financial officer….. The county expects to collect $25.5 million from taxpayers, about $1 million more than what was collected in 2007. Although the tax rate will drop 1 cent to 81 cents per $100 assessed valuation, property values are projected to increase 5.4 percent, so homeowners actually will pay more taxes to the county. The owner of a $120,000 home, whose value increases the projected 5.4 percent will pay $341.50 in taxes to the county, or $13.50 more than last year.”

- “In total, the city’s staff whittled a $2.2 million budget deficit down to $117,771, an amount that some council members praised. ‘We asked an unbelievable task of our staff,’ Mayor Jim Ardis said. ‘Without cutting any positions or having any tax increase.’ …Finance Director Jim Scroggins said the biggest savings comes from the city’s health care costs, reflected in a substantial difference between the 12 percent budgeted increase for 2008 and the actual increase in health-related costs of only 4 percent…. In addition, the city plans to scale back on parking deck repairs ($300,000), repairs to some of its buildings ($200,000), delay repairs to police headquarters ($25,000), and reduce the neighborhood signs program ($68,662).”

- “Illinois’ backlog of unpaid bills has hit a record $4 billion, and Comptroller Dan Hynes said Thursday the situation is ‘potentially catastrophic’ if allowed to continue…. Earlier this week, Blagojevich’s office said state revenues will fall $800 million short of projections because of the recession. The Senate Democrats’ top budget person, Sen. Donne Trotter of Chicago, said borrowing money right now may not be a good idea because of interest costs. He said the state should tap into its ‘rainy day’ fund first. Hynes said money in the rainy day fund was used in July. Trotter’s Republican counterpart, Sen. Christine Radogno of Lemont, also didn’t think much of borrowing money. ‘That’s exactly what’s gotten us into this problem,’ Radogno said. ‘Continuing borrowing is not a good idea. They’re going to have to look at making cuts. The wiggle room is gone.'”

It’s time to use all that advertising money to come up with another plan — one that doesn’t involve raising taxes.

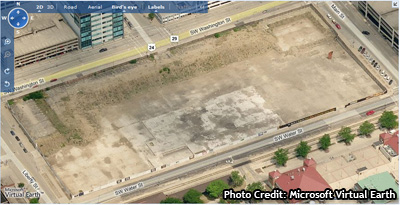

Museum Block, before it was turned into a temporary parking lot

Museum Block, before it was turned into a temporary parking lot