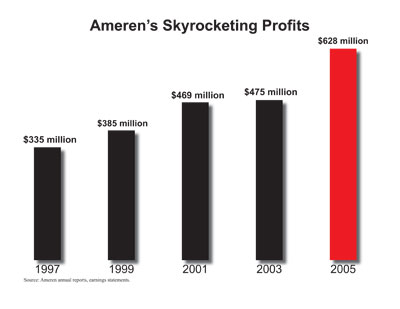

The Citizens Utility Board (CUB) has compiled some interesting data on Ameren. Starting in 1997, the year electricity rates were frozen by the state, they graph Ameren’s profits every other proceeding year, right up to 2005. One would expect profits to be modest at best, given the handicap of a rate freeze. But check this out:

Doesn’t look like the price freeze negatively affected their ability to nearly double their profits over the past ten years. So, it appears Ameren doesn’t really need that 55% increase, does it? It would be fair for someone to retort, “Why shouldn’t they be allowed to raise their rates 55%? Let the free market decide!”

Ah, but therein lies the problem. Ameren is still a monopoly in residential services. If you don’t like the Ameren rate hike and decide to go with their competition… you can’t, because there is no competition. Thus, consumers do deserve protection from price gouging — and a good case can be made that this is, in fact, price gouging.

There are those who are trying to help. CUB has “filed a brief with the appellate court, arguing the [rate hike] plan is illegal and hits consumers with unfair market prices at a time when the power companies still hold a monopoly on residential services,” according to today’s Journal Star. And Illinois Attorney General Lisa Madigan is trying to get the results of the recent reverse auction thrown out on the same basis.

CUB also reports, “Under the Electric Consumer Protection Act, HB 5766, rates would be frozen for another three years or until at least 33 percent of residential customers have switched electric suppliers.” So, it looks like there’s a possibility that 55% rate hike may not take effect in January after all.

Here we go again, comparing apples to oranges, which CUB loves to do. In the period shown on CUB’s graph, Ameren acquired two companies (CILCO and Illinois Power) and their sales and the profit from their sales are reflected in the last few years but not in the starting date of 1997. According to information readily available on the internet, Ameren has assets of $18 billion. Ameren’s ROA (return on assets or net income divided by total assets) is 3.5%. Caterpillar’s ROA is 6.1%, Best Buy is 9.6%, AT&T is 3.3%, UPS is 11% and Microsoft is 19.4%. Not out of line at all.

Translation:

% this and % that. Somebody cooked the books and now they’re sticking it to Joe Taxpayer.

No offense Neil , I do appreciate your intellectual ability to provide stunning statistics and pertinent facts related to every issue you find relevent to respond too.

The term “price freeze” to me, just sounds like clever marketing. I seez it like this, follow me…

CEO:

Yep, junior is ready to go to college next year, and I will finally be able to retire to Hilton Head, SC. I can see the golfcourses now.

Meanwhile…The younger daughter screaming…but if billy gets to go to Harvard, then I want my pink volkswagon passat.

I need a raise….oh, yeah…fire the accountant, shred everything you see and blame it on him. Put the increase up 55% in the newspaper tomorrow, and nobodys the wiser.

While Neil shows Ameren’s ROA as 3.5%, Ameren’s web site shows it as 4.6%; probably a timing difference. Ameren also reports their ROE, or return on common equity, as 10%. For a largely regulated utility, that’s a healthy return. Gross earnings numbers aren’t overly relevant due to Ameren’s growth through acquistions – since 1997 Ameren has acquired three large Illinois utilities, CIPS, Ill. Power, and CILCO.

Earnings per share is a much more important financial number. While Ameren’s gross earnings grew substantially, as C.J. points out, their shares of stock outstanding also grew to finance the acquisitions. But even with the additional stock, Ameren’s earnings per share, or EPS, have grown as well. In 2003, for example, EPS was $2.95, and in 2005 it grew to $3.13. While it appears 2006 EPS will be down somewhat, analysts are projecting 2007 EPS of $3.90 (that number may reflect assumed rate increases). So how has Ameren’s earning results improved with a rate freeze? – several reasons. First, the rate freeze applied to electric retail rates only, not natural gas or electric wholesale rates. Secondly, a big portion of Ameren’s electric generating plant fleet has been transferred to a non-regulated subsidiary, and the rates for sales out of those plants are largely market-based rather than set by the government. Thirdly, the acquisitions have provided the opportunity for Ameren to wring huge costs out of its operations, through elimination of duplicate functions and other costs. Yet another measure of Ameren’s health, and maybe the most important, is the market performance of its common stock. In January 1998, Ameren was trading at $18.40/share; it closed today at $52.70/share. On top of that price appreciation, Ameren has been paying cash dividends every quarter during that period; its current dividend yield is 4.8%, representing the annualized cash return today’s investor would receive.

Geez, Silence No Good, no offense taken, particularly since you haven’t been able to rebut anything presented here with facts. Sorry if my responses to relevant issues bother you. Kind of thought that’s what this was all about. But clearly if someone doesn’t meet the typical blogger’s pre-conceived ideas arrived at with incorrect and misleading information, then they are heaped upon with all kinds of clever, personal attacks, but alas never with a winning argument. I’ve been called all kinds of nasty things in just a couple of weeks of posting here, all by people who are anonymous and choose to hide behind phony names when they attack someone. Sadly, my time here is done. It’s really not a challenge. It’s too easy to point out your flawed thinking. So now you can all chat among your anonymous selves, reveling in your narrow, uninformed view of the world, patting each other on the back at how witty you are, while those of us capable of carrying on intelligent discourse do so without wasting our time pointing out facts to those who aren’t interested in them. Sorry, CJ, I tried to stay civil. But civil is as civil does. Cheers.

Thanks, Neil. I’m sorry you’ve had a bad experience with blogging. I personally liked your comments, as I always like to hear the other side of the story — your explanation for the rise in profits makes sense. I thought that “SA” had some good — and civil — responses to your comments, too.

I wish you were still reading, because I wanted to ask you what you thought of CUB’s & Madigan’s main argument — that this auction should not be allowed because residential service has no competition. I’m all for companies making a profit off their services, but if they’re a monopoly (and they are), then I think it’s appropriate for prices to be regulated to protect consumers.

Sorry to see you go Neil. The local bloggers can be pretty tough so thick skin is helpful.

You might consider checking your arrogance at the door the next time you enter a room.

Neil, I never said that facts bother me. Nothing you have just ranted about is justified by a comment given from me. I have not argued with you, or called you any nasty names. I actually said that I respected your views and information gathering.

Relax, your the civilized one…remember? The good communicator, the one with all the answers?

Narrow, uniformed? You were just here a half hour ago!

All of my arguing points have been proved by the last response you just gave. Thanks for proving my theory correct.

Have a great day!

I am now forever leaving the blog world…I should be remembered as the Infamous Silence NoGood. Soo long everybody!

Some of us have good reasons to remain anonymous, Neil … not that you’re “listening” anymore, apparently.

My training is not in finance, but let me make an “uneducated” observation here. Isn’t the fact that Ameren was able to purchase several other utilities while prices were frozen indicative of its financial health during that time? Yeah, sure … the purchase of other utilities skews the numbers. However, it hardly indicates that the company is struggling. I’m sure some poorly run companies go on shopping sprees right before they go bust, but that description does not seem to fit Ameren.

Wait a second! Where does the museum fit in with all of this?

Neil,

I am sorry to see you go. Let’s see. You are a huge supporter of Lakeview Museum project and come running to the defense of AMEREN? You seem to know a little about a lot. Are you one of those “rich business guys” sticking your nose where it does not belong? It is irksome to see anyone defend a %55 or even %1 rate increase in power. Just how the HELL are we going to afford our trip to Lake of the Ozarks this year!!! Perhaps your one saving grace is, I have never heard of a Neil Hardin. Maybe you should develop a catchy blog name.

NEIL HARDIN, Assistant Coach

Neil Hardin has served seven seasons as men’s basketball assistant coach at Sam Houston State. Hardin’s duties include helping plan and run practice, opponent scouting, recruiting, and off season individual skill instruction.

A member of Bob Marlin’s staff since Marlin became head coach in 1998, Hardin has played an important role in directing the Bearkats to an 85-57 record, the best record in the Southland Conference the past five years.

That record includes two Southland Conference regular season titles and an SLC post-season tournament victory and NCAA championships appearance in 2003. The Bearkats have posted victories over every team in the Southland Conference and non-league wins over such top teams as Baylor (Big 12), Houston (Conference USA), Montana State (Big Sky), Chattanooga (Southern), and New Orleans (Sun Belt). The men’s basketball program earned the Southland Conference’s highest NCAA Division I RPI in the past five seasons last year.

“Neil has been one of the main reasons for our success during the last five years,†said Bob Marlin. “He has done a good job in all areas, but specifically in our off-season individual workouts. He has recruited good players and helped make them better.â€

Hardin is from Pensacola, FL. He worked with current SHSU Head Basketball Coach Bob Marlin from 1992 to 1995 at Pensacola Junior College and was with Marlin when the Pirates won the National Junior College Athletic Association (NJCAA) National Championship in 1992-93. Pensacola produced an overall record of 74 victories and only 22 defeats during those three seasons, a winning percentage of .771.

Hardin attended the University of West Florida in Pensacola while working with Coach Marlin and the Pirates. He received his Bachelor of Science degree in Sports Science from West Florida in 1995. In 1996, Hardin followed Marlin to the University of Alabama in Tuscaloosa where he worked as a graduate assistant. Hardin helped monitor the academic progress of Crimson Tide student athletes in each sport. He primarily worked with the men’s basketball and baseball programs. He also assisted with the daily Crimson Tide men’s basketball practices. Hardin earned his Master of Arts degree in Exercise Physiology from the University of Alabama in 1998.

Hardin is the son of Emery and Celia Hardin. He and wife, Melissa, who is a Sam Houston State graduate and played volleyball for the Kats, have a daughter, Alexis, who was born in July, 2002.

In addition to his coaching duties, Neil enjoys blogging about issues of the day in his favorite city, Peoria, IL.

This whole thing is the government’s fault. Deregulating a monopoly did not foster competition because we still have a monopoly. It needs to be regulated.

In one aspect, Ameren IS caught in the middle here. They ARE being forced to buy 70% of their power on the open market after Jan 1. They own and operate many generation facitilies yet will only be able to use 30% of the power they make. It is easy to gripe about Ameren making a profit but any company would do that given their situation. Ameren is not raising the rates on their own accord.

I think Ameren is TRYING to make the impact on us less by proposing to stage the rate changes over 10 years.

The ICC needs to re-regulate the monoploy.

Ameren and other electric utilities have opposed and slowed the transition of the generation and transmission segments to becoming fully competitive. Those parts of the industry, unlike the local wires, customer service and rates, are within the purview of the feds. That is where the bottlenecks and problems lie. Federal rules and the transition of generating plants and transmission facilities to competition have lagged behind state deregulation laws. Owners of generation (including Ameren) that bid into the auctions will be getting very favorable prices until there is sufficient generation and transmission plant to permit more bidding and selling.

The feds are further removed from local voters and other constituents, making it harder to have an influence. I don’t know if the State can do much at this point, as the Jeannie is out of the bottle.

Genie, sorry

SA,

O.K.

but who is Neil Hardin really?

Ameren didn;t buy the generating plants, right?

Ameren transferred most of the generating plants that formerly belonged to their CILCO and CIPS utility subsidiaries into another unregulated Ameren generating subsidiary. Ill. Power transferred its generating plants to its sister company prior to Ameren’s acquistion of Ill. Power. Ameren’s unregulated generating subsidiary is eligible to sell power into the Illinois auction, as well as selling into the wholesale markets generally. Starting 1/1/2007, Ameren’s regulated Ill. electric utilities – CILCO, CIPS, and Ill. Power – will pass through the costs of power purchased at wholesale, whether from the Ameren generating company or non-affiliated generators, on a dollar-for-dollar basis. So while Ameren’s regulated Ill. utilities will not make a profit margin on the power purchases and recoveries, Ameren’s generating subsidiary will be allowed to make whatever profits the auctions and other wholesale markets will bear.

The utility subsidiaries will make their profits from the distribution/delivery of the electricity, which rates are regulated. It should be noted that the Ill. Commerce Commission will rule in November on Ameren’s requested delivery service rate increase request of over $200 million, allocated among Ameren’s 3 Ill. utilities. These are the rates that have essentially been frozen since 1997. But remember that in 1997 Ameren did not own CIPS, CILCO, or IP. Each of those utilities had rates set to recover their respective cost of service plus a profit margin. So when Ameren acquired those 3 utilities (the first one starting in 1998), even though it couldn’t raise rates, it didn’t need to because it made massive cuts in the cost structures of its 3 utilities through elimination of duplicate costs and improved efficiencies from economies of scale.

It appears that the initial auction prices on a $/mWh basis, which just wrapped up, were significantly higher than the cost of generating the output that will be sold, suggesting profit margins will be high for the generating plants, including Ameren’s, that bid (sold) into the auction.

So, we are all facing a double whammy come january 2007. The large price increase passed through by the utilities from the power auction, plus the utilities’ own delivery rate increase, which we will know sometime in November.

But just to be clear, Ameren IS opposed to the deregulation and rate hikes, right?

Tony,

you seem to have the same facts that I was given by more than one legislator. It was bad legislation done 10 years ago and de regulating a monopoly isn’t working. What now needs to happen is a legislative session called now by the govenor or those with constitutional authority to do so. A simple rate freeze is not going to fix the problem because it has become a large mess. For the record this bill 10 years ago had bi-partisan support, but not local support. We are suffering from legislation designed to meet up state needs vs. statewide needs. Waiting to work on this issue until after the elections is only going to make it worse for the consumer.