Heritage Bank of Central Illinois entered into a consent agreement with the Federal Deposit Insurance Corporation (FDIC) and Illinois Department of Financial and Professional Regulation on November 2, 2009.

Heritage Bank of Central Illinois entered into a consent agreement with the Federal Deposit Insurance Corporation (FDIC) and Illinois Department of Financial and Professional Regulation on November 2, 2009.

Regulators charged the bank with “unsafe or unsound banking practices,” including “[o]perating with an inadequate level of capital protection for the kind and quality of assets held,” “[o]perating in a manner which has resulted in inadequate earnings and losses to the institution,” “[e]ngaging in hazardous lending and lax collection practices,” and “[o]perating with an inadequate loan policy.” Heritage Bank neither admitted nor denied the charges, but did agree to modify its practices as outlined in the consent agreement.

I asked Heritage Bank for their comment and received an e-mail from president M. Scott Hedden (reprinted at the end of this post). It basically says that regulations have been tightened on all lending institutions in the aftermath of the sub-prime mortgage crisis, even though most of the sub-prime loans came from non-bank lenders. These “onerous” regulations are making it harder for the bank to help their loan customers resolve “financial challenges and hardships” brought on by the “current economic climate.”

In other words, what the bank calls “helping customers resolve financial challenges,” regulators call “hazardous lending and lax collection practices.” To use the movie “It’s a Wonderful Life” as a metaphor, Heritage Bank is George Bailey and the regulators are Mr. Potter. Remember this exchange?

MR. POTTER: Have you put any real pressure on these people of yours to pay those mortgages?

PETER BAILEY: Times are bad, Mr. Potter. A lot of these people are out of work.

POTTER: Then foreclose!

BAILEY: I can’t do that. These families have children.

POTTER: They’re not my children.

BAILEY: But they’re somebody’s children, Mr. Potter.

POTTER: Are you running a business or a charity ward?

No doubt the truth is somewhere in between. There are probably some banking practices that really do need to be improved at Heritage Bank, while at the same time it’s true that regulators often get carried away, especially in times of crisis (witness the security excesses at airports these days).

The bottom line is that improvements are being made. Mr. Hedden says “the bank has already implemented and achieved many of the requirements contained in the Agreement. Most significantly, the bank has already met and exceeded the capital requirements set forth in the Agreement by raising capital through private, local investors.”

Continue reading Heritage Bank complying with FDIC agreement

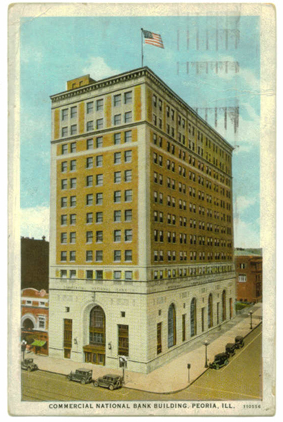

According to their website, AFRT is “a self-managed, self-administered real estate investment trust (REIT) focused on acquiring, managing and operating properties leased primarily to regulated financial institutions.” Put simply, they buy bank buildings and lease them back to the banks at rates that are mutually beneficial. That frees up more money for the bank to lend.

According to their website, AFRT is “a self-managed, self-administered real estate investment trust (REIT) focused on acquiring, managing and operating properties leased primarily to regulated financial institutions.” Put simply, they buy bank buildings and lease them back to the banks at rates that are mutually beneficial. That frees up more money for the bank to lend.