The proposed redevelopment agreement (aka “wonderful development”) for the Pere Marquette hotel was finally made public at 5:00 p.m. on Friday. Monday night, the council will be voting on it. Council members have to read all the details online because the hard-copy packets weren’t ready by the end of the day Friday. Talk about a fast track!

In reading the agreement, some things caught my attention, and I hope the council members consider these items carefully before voting. In fact, it would be better if they deferred this until their next meeting instead making a hasty decision, but I’m not holding my breath expecting that to happen. Anyway, here are my concerns:

1. The use of General Obligation Bonds

The nearly $40 million in city funding is proposed to be in the form of general obligation bonds instead of revenue bonds. Both types of bonds would be paid back out of revenue generated by the project, assuming the project is profitable. The catch comes if the project is (God-forbid) not profitable. General obligation bonds are backed by the full taxing authority of the city. So if the project goes south, the bonds get paid for out of the city’s general fund — that is, taxpayers assume the risk. Revenue bonds are backed by the hotel building itself (which is used as collateral) and/or a specified revenue stream (H taxes, for instance), so if the project goes south, bond holders would be able to foreclose on the hotel, but the city wouldn’t be obligated to settle up the debt out of the general fund. As a taxpayer, that makes me nervous.

The explanation given in the packet is a bit cryptic: “A revenue bond is not likely to be successful because there is no current revenue and, thus, no history on which to base a revenue stream. A revenue bond would almost certainly result in a higher interest rate for the City.” Perhaps someone out there with a finance background can explain this to me. I thought the lack of history for a revenue stream was precisely why revenue bonds had higher interest rates. Under the scenario presented, when would a municipality ever be able to utilize revenue bonds for new construction?

2. Optimistic occupancy projections

The developer of this hotel project is anticipating occupancy rates of 60% in 2012, 69% in 2013, 72% in 2014, and 74% in 2014 and beyond — best-case scenario. However, the developer also states that the hotel will be successful even under more conservative figures: 60% in 2012, 65% in 2013 and 2014, and 68% in 2015 and beyond.

The Pere Marquette had a 54% occupancy rate in 2005, according to published news reports. And in September 2006, a Civic Center Hotel Study was prepared by HVS Convention, Sports, & Entertainment Facilities Consulting. They were looking at building a new hotel immediately adjacent to the Civic Center that would add 250 rooms to the hotel market and compete with the Pere and other downtown hotels. The project being proposed now, of course, is an expansion of the Pere by 200 rooms (the addition of a new tower). Their market analysis concluded:

HVS estimates a stabilized occupancy of 67% for the proposed Civic Center Hotel. Although the subject property may operate at occupancies above this stabilized level, we believe it is equally possible for new competition and temporary economic downturns to force occupancy levels below this selected point of stability.

So, the stabilized occupancy rate prediction was 67% in 2006 — before we entered a recession — which is a point lower than the “conservative” stabilized rate the developer is now using for his projections — in the midst of a recession.

When this report was presented to the City Council, Bob Manning asked about that projected occupancy rate and whether it could support a 250-room hotel:

Discussion was held regarding the projected number of room stays and how the projections were determined. Council Member Manning expressed concern regarding how the occupancy rate was determined, which he felt would not support a 250-room hotel. Mr. Hazinski said he agreed and that was the reason the study projected a decrease in occupancy rates in the market. He said the market ran in the mid-sixties when it was doing well, and really could not be expected to do better than that.

Given this information, and the fact that we are in a recession, it would seem that the more conservative figures are closer to the truth. And if you look at the bond payment scenario based on those conservative figures, there’s not a whole lot of room for error. It looks like, if they miss their projections on those occupancy rates by even a little bit, they could be quickly operating in the red. Guess where the money comes from to make up the difference if that happens — money that could be used to pay police officers or fix streets and sidewalks.

Also, what’s the average room rate going to be? That seems like a reasonable piece of information to include, especially in financial predictions. It will make a difference when it comes to occupancy rates. If these rates are higher than the Embassy Suites and a newly-renovated Holiday Inn, will budget-minded conference-goers and their employers opt for cheaper room rates and forgo the luxury and convenience of an attached “headquarters hotel”?

3. Questionable comparisons.

In the Request for Council Action cover memo, Interim City Manager Henry Holling mentions several other hotel projects in Illinois that used government subsidies, including Normal, East Peoria, and Tinley Park. So I thought I’d look up a little info on those projects.

- Normal Marriott — This project should give us pause. According to documents available on the Normal.org, “In July of 2004, the Town of Normal entered into a redevelopment agreement with Mr. John Q. Hammons of Springfield, Missouri pertaining to the construction of a full service Marriott Hotel and Conference Center along with a required parking structure…. [T]he total project cost was estimated by the developer to be approximately $43 million ($30 million-hotel; $8 million-conference center; $5 million-parking garage).” Normal’s subsidy was estimated to be about $13 million toward the project. However, by October 2006, the estimated cost of the project had risen dramatically to $72.6 million — a $29.6 million (68.8%) increase! That, of course, meant that the Town of Normal’s share also ballooned to $21.1 million. Despite that huge increase, their share of the overall investment was only 29%. Here in Peoria, the city’s share of the Marriott project would be 40%.

- East Peoria Embassy Suites — In 2003, the plan was to build a publicly-owned conference center and a privately-owned but publicly-subsidized Embassy Suites. The developer was the same as in Normal — John Q. Hammons. Fortunately for East Peoria, the costs didn’t rise as much as they did for Normal, only going up to $60 million. Holling’s memo states, “The level of subsidy [being proposed in Peoria] is also similar to the level provided for the Embassy Suites in East Peoria, which was also approximately 40% of the total project costs.” Yes, but we’re comparing apples and oranges here. In East Peoria, their $25 million subsidy paid for 100% of the conference center with the rest going toward the hotel. $25 million is about 42% of $60 million. But if you look at East Peoria’s subsidy to the hotel alone, it only comes out to 27% ($13 million out of $48 million). In 2007, the city decided to lease the conference center to Hammons for a progressive annual fee. They use that money to pay off its construction cost ($12 million) plus maintenance and improvements instead of relying on what one East Peoria commissioner called “unpredictable net revenue.”

- Tinley Park Convention Center with Holiday Inn Select — According to Mr. Holling, “Tinley Park built their center with substantial governmental assistance, and is preparing a major expansion.” In the context we’re talking about, that sounds a bit misleading. Yes, construction of their approx. $6 million publicly-owned convention center was funded 100% by a $7.5 million bond issue. But the adjacent Holiday Inn Select was built with little governmental assistance compared to Normal and East Peoria. The only governmental assistance that $15 million project received was inclusion in a TIF district and some assistance with land acquisition. The hotel plan actually predated plans for the convention center and was part of a development of 300 town homes, also included in the TIF district. The Chicago Tribune reported just this month (12/4/2008) that an expansion is planned: “Tinley Park owns the convention center and will invest more than $10 million in the project. The money will come from tax-increment finance revenues, which come from increased property value from a designated area.” The hotel is also expanding, but on its developer’s own dime. Mid-Continent Development and Construction, “which manages the [convention] center and owns the adjoining Holiday Inn Select…plans to invest $10 million into upgrades to the hotel, including 68 new rooms and a second kitchen to the six-story hotel.”

None of these projects approach the kind of deal being proposed in Peoria. The highest subsidy among these three initiatives was 29% of the total project cost. So why do we need to pay 40% in Peoria? Holling explains: “The Embassy Suites did fund the Conference center construction, but site acquisition and assembly was lower cost and no parking structure was required.” So, apparently, the reason why Peoria taxpayers need to pony up more money is to help with land acquisition ($22 million) and parking ($10 million). And of course the $5 million sky bridge. Those three things total about $37 million.

So, the question is, is it worth it? That’s the ultimate question that needs to be asked and answered Monday night.

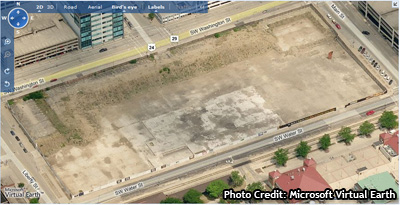

UPDATE: Regarding land acquisition, the Journal Star reports the Pere Marquette is being acquired for $11 million. The information presented to the City Council indicates that total acquisition costs are $22 million. That means the remaining properties (Lasher building and Big Al’s entertainment complex) are being purchased for $11 million. Yet the fair market value of those buildings, according to the Peoria County Assessor (and the amount on which they pay property taxes), is only $1,353,540. Even going by recent sales amounts, the Lasher building (corner of Main and Monroe) sold in August of this year for $1.05 million, and the four parcels that make up Big Al’s entertainment complex sold in 2004 for $1.5 million. That’s a total of $2.55 million for all the buildings — yet the City is poised to purchase them from Al Zuccarini for $11 million. Plus, they’ve already facilitated his move to an as-yet-undisclosed location, likely to be 414 Hamilton Blvd., by changing their adult use ordinance. Wow. One would think with that kind of money (our tax money, by the way), Al could have found a place that complied with the adult use ordinance as it stood.

UPDATE 2: The Journal Star agrees with me. Excellent editorial. That new guy is working out okay. 🙂

The City Council on Tuesday night chose a new logo for Peoria to replace the Indian-head logo. The new logo is pictured to the right. It’s blue, green, and yellow, and features silhouettes of the twin towers, Commerce Bank building, and Murray Baker bridge. The city paid Converse Marketing $30,000 to design the new logo.

The City Council on Tuesday night chose a new logo for Peoria to replace the Indian-head logo. The new logo is pictured to the right. It’s blue, green, and yellow, and features silhouettes of the twin towers, Commerce Bank building, and Murray Baker bridge. The city paid Converse Marketing $30,000 to design the new logo.