Recent votes by the Zoning Commission and the City Council undercut the very basis of the city’s recently-adopted Land Development Code. The controversy centers around a special use request from St. Ann’s church.

St. Ann’s church wants to build an 8,000-square-foot parish hall adjacent to their church on the south side of Peoria, 1010 S. Louisa St. In order to do that, some land has to be rezoned (to “R4” residential) and a special use permit granted (for church use), which means it had to go before the Zoning Commission. The zoning regulation for this area is the recently-adopted Land Development Code.

Land Development Code

Since this is a special use request, the Land Development Code (LDC) does not have specific guidelines. After all, the writers of the Land Development Code couldn’t possibly foresee and codify regulations for every conceivable special-use request. But what we do have are the intent statements in the document. For example, the intent statement in the LDC for R4 districts reads (4.1.1.D):

The R4 District is intended to preserve established single-family neighborhoods within the Heart of Peoria. The district is also intended to allow for new single-family houses on small lots in development patterns that mimic established portions of surrounding neighborhoods at a density not to exceed 11.62 gross dwelling units per acre.

Add to that the overall intent of the entire LDC (1.5.A and B):

The overriding intent of this development code is to implement the Heart of Peoria Plan…. New development regulations for the Heart of Peoria are necessary because the existing zoning and subdivision ordinances include provisions that work against the realization of a revitalized, pedestrian-friendly commercial areas, and the renovation and preservation of inner city neighborhoods. This development code in contrast with previous codes, focuses on the creation of mixed-use, walkable

neighborhoods.

It goes on to state some specific intentions of implementing the Heart of Peoria Plan, including, “Prohibit blank walls along the sidewalk,” “Use the scale and massing of buildings to transition between the corridors and surrounding neighborhoods,” “Promote infill development for vacant parcels that reflects the surrounding scale and character,” “Control the scale and fit of new development patterns,” and “Use the commercial corridors as a seam sewing neighborhoods together rather than a wall keeping

them apart.”

Furthermore, the specific regulations for R4 districts give some guidance as well. They include such things as, “Roof height and building profile for new buildings shall seek to be compatible with adjacent structures” (4.1.5.B.2), “The scale and mass of new homes or remodeled houses shall be compatible with adjacent houses” (4.1.5.G.1), “Building materials for new houses shall be similar to other houses on the block” (4.1.5.G.3), and “Architectural styles shall be compatible with other architectural styles on the block” (4.1.5.G.4).

Not all regulations that apply to houses can be applied to an 8,000-square-foot parish hall (e.g., porches), but it’s clear from the LDC that scale and mass, architectural styles, and building materials are all important items.

Planning and Growth

So when St. Ann’s came to the city asking for this special use and proposed a building that looks like this (click for larger view):

…naturally, Planning and Growth had some concerns. It looks like a warehouse. It’s architecturally incompatible with other structures on the block. The scale and fit of this structure is wrong for the neighborhood. So, Planning and Growth made a simple recommendation regarding this problem (Wikipedia link added):

The architecture of the parish hall shall be modified through the use of ground level windows, pilasters or other architectural features which break-up the mass of the structure into smaller visual components.

They didn’t ask them to redesign the whole building. They didn’t ask them to make the building smaller. All they asked was that some elements be added that would make the architecture and scale look and feel more compatible with the block, consistent with the LDC’s intent.

Zoning Commission

Well, that went over like a lead balloon at the Zoning Commission meeting. First, the petitioner stated that adding windows couldn’t be done because there’s too much vandalism in the area and the windows would get broken. Think about that logic for a while and how such a view, if accepted, could influence the built environment on the south side. He also stated he didn’t want “some arbitrary opinion” of what would be acceptable architecture for the building. Of course, neither does city staff — they can’t legally require something that’s “arbitrary.” Thus, they based their recommendation on the LDC, as explained above.

Several of the Zoning Commission members, however, agreed with the petitioner and questioned why the city was making architectural suggestions at all — as if form-based codes were a completely foreign concept to them. (In fact, that’s likely the case, since the most outspoken opponents of P&G’s suggestion didn’t attend any of the consultant-selection meetings, the subsequent charrettes, or the all-committee training sessions.) The Journal Star reported on the meeting, and printed these quotes:

“I’m surprised the city of Peoria is getting involved in the architectural business,” commissioner Richard Unes said. Commissioner Greg Hunziker agreed. “I don’t think we have the authority to tell them how to build their building.”

City beat reporter John Sharp went on to describe how “some were upset that it would be up to the Planning and Growth Management Department to ultimately determine if the architecture was good enough for the project to move forward.” (PJS, 11/02/2007)

These comments are representative of the discussion. Unes’s comment is especially interesting since he shouldn’t have been discussing the item at all — his company, Peoria Metro Construction, is doing the design and construction work for St. Ann’s (he did abstain from voting, at least). But I digress. These comments display a disturbing lack of understanding regarding the purpose of the LDC and the authority of the City to regulate the built environment through the use of form-based codes.

I talked to Heart of Peoria Commissioner Beth Akeson about the Zoning Commission’s deliberation. She said that “the city has a duty to intercede when building proposals, such as the addition to St. Ann’s, are brought forward,” and that “the best cities in the country routinely influence decisions like these.”

Of course, the Zoning Commission doesn’t have any input from the Heart of Peoria Commission because, since the resignation of Chad Bixby, there has been no Heart of Peoria Commissioner assigned to the Zoning Commission. You may recall that the Committee on Commissions recommended that the Heart of Peoria Commissioners be dual-appointed to other key commissions in the city, including the Zoning Commission.

In the end, the Zoning Commission voted to approve the special use request, but specifically excluded staff’s recommendation to modify the architecture. That sent it on to the City Council, which considered the request last night.

City Council

The City Council stood by the Zoning Commission’s recommendation, but for different reasons. At-large councilman Eric Turner and first-district councilman Clyde Gulley expressed concern over the additional costs of making the building compatible with the surrounding architecture. They feared that requiring the building to look better would keep redevelopment from happening. Now think about that logic for a while. The only conclusion I can draw is that they believe any development, no matter how incompatible, is better than no development. And that belief, dear readers, is why Peoria looks the way it does.

Interestingly, no actual cost estimates were provided for consideration, nor was there any indication from the church that they would scrap their plans if the city were to require the building to look better. So these concerns were acted upon in the absence of any real facts. The council voted to approve the Zoning Commission’s recommendation with only council members Sandberg and Van Auken voting “no.”

Conclusion

In fact, it probably would cost more to make the building more compatible. No one is denying that. But no one is considering the cost of incompatible building design. Do you think home values next to this warehouse-looking structure are going to go up or down as a result of this development? Do you think the houses on Cooper are going to go up or down in value once the five-story parking deck is in their back yards? It’s not that these mixed uses can’t exist side-by-side in harmony; it’s that the form of the built structure makes all the difference. This is Form-Based Codes 101.

Commissioner Akeson said it best when she wrote to me recently, “additional cost in the short term will be outweighed by the long-term benefit of infill that contributes to the overall value of homes in the older neighborhoods. Home values are influenced by construction quality and architectural design. Inappropriate infill will reduce the value of neighborhoods. The only way to guarantee improved quality of future infill projects is to set minimum basic standards to improve quality and design.”

During the deliberation of St. Ann’s special use request, the Zoning Commission and City Council have expressed objections that undermine the purpose and goals of the Land Development Code — a code that they voted for, based on a Plan that they adopted “in principle.” Let’s hope this was an exception, and that the exception doesn’t become the rule.

Lakeview Museum Board President Jim Vergon said at last night’s museum presentation to the Peoria County Board, “Over the past four years, our project has received $6 million towards the $30 million goal for public funding, leaving a $24 million gap.” He said this included federal, state, and local support. Later, Caterpillar Vice President Sid Banwart drove home the point: “We’ve looked at a lot of museum complexes around the country and around the Midwest, and we have not been able to find any that were built without substantial public funding,” he said.

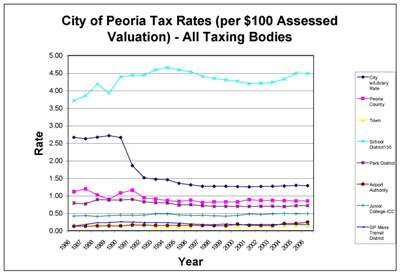

Lakeview Museum Board President Jim Vergon said at last night’s museum presentation to the Peoria County Board, “Over the past four years, our project has received $6 million towards the $30 million goal for public funding, leaving a $24 million gap.” He said this included federal, state, and local support. Later, Caterpillar Vice President Sid Banwart drove home the point: “We’ve looked at a lot of museum complexes around the country and around the Midwest, and we have not been able to find any that were built without substantial public funding,” he said.  The city council is going to have a chance again to make some decisions about how they raise revenue. Specifically, they’ll have to decide whether they will be raising property taxes.

The city council is going to have a chance again to make some decisions about how they raise revenue. Specifically, they’ll have to decide whether they will be raising property taxes.