It looks like the County, which has been trying feverishly to squander $40 million on a poorly-planned museum, took some time away from that project to potentially throw away another million:

Peoria County could temporarily pick up slack for the state of Illinois after preliminary approval to issue a $1 million line of credit to the Peoria Regional Office of Education to meet payroll.

In an unprecedented move, the County Board’s finance committee approved issuing the credit Thursday, though it still must be approved by the full board on March 11.

Genius! Since the taxes we pay to the state aren’t being distributed to the Regional Office of Education (ROE) in a timely manner, the taxes we pay to the County are going to be used to help the ROE meet payroll. Then, the taxes we pay to the state will (they hope) be paid back to the County plus interest of around 3%. Who pays that 3% interest? The taxpayers! Yes, when one government body charges another government body interest, what that really means is our tax money being flushed down the toilet. Since both government bodies cover the same taxpayers, we’re essentially charging ourselves interest.

The article goes on to explain what the money would be used for specifically:

Delayed payments from the state of Illinois have created a cash flow emergency in the regional office’s Two Rivers Professional Development Center, an intermediate educational service provider.

Staffers for the regional office and Two Rivers are implementing a $12 million virtual school contract with state money.

The virtual school offers 130 courses, from core subjects such as math, English and science to foreign languages, health and business online. It serves about 120 schools across the state, with about 3,000 students in public, private and home-school settings from fifth grade through high school enrolled annually.

“If we don’t get the credit, the program shuts down. We can’t meet payroll,” Brookhart said.

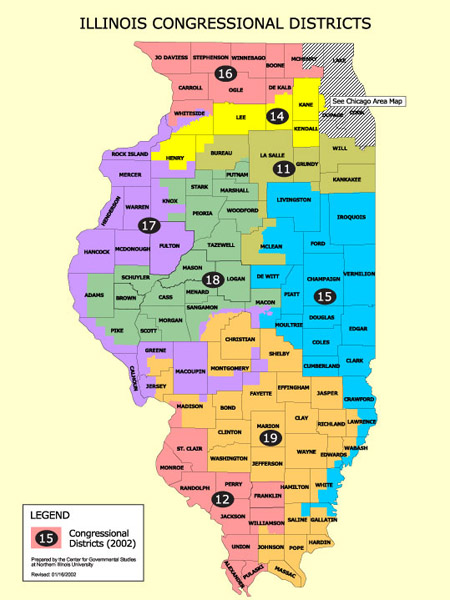

The Illinois Virtual School was established in 2001, according to published reports. Their website states, “The Peoria Regional Office of Education (ROE), in partnership with the Area III Consortium*, was awarded the Illinois State Board of Education (ISBE) contract to manage and operate the Illinois Virtual School (IVS) on April 1, 2009…. The Area III Consortium is a partnership of 10 Regional Offices of Education located in west Central Illinois, the Area III Learning Technology Center, Two Rivers Professional Development Center and Western Illinois University.” The ten regional offices cover the following counties: Adams, Pike, Brown, Cass, Morgan, Scott, Fulton, Schuyler, Hancock, McDonough, Henderson, Mercer, Warren, Knox, Logan, Mason, Menard, Peoria, Sangamon, and Tazewell.

Given all that, several questions come to mind:

- Why is it suddenly Peoria County’s responsibility alone to keep this program running? Where are the other 19 counties involved?

- Considering Peoria County is itself facing revenue cuts from the state, how is it that they think it’s prudent to cover the state’s shortfall to the ROE?

- How is it that Peoria County can afford to make a risky $1 million loan to anyone when they spent $4.2 million more than they took in last year?

- If the state doesn’t come through with the money, how will Peoria County be repaid? Specifically, from what revenue source will they be repaid?

- How important is this Illinois Virtual School program? Maybe this is a program that needs to be shut down if the state is unable to pay its bills.