In his work, “Democracy in America,” Alexis de Tocqueville notes, “A democratic government is the only one in which those who vote for a tax can escape the obligation to pay it,” and he questions whether a free society can long survive that discovery. Obviously that discovery has been made, for many more are eligible to vote than are required to pay, and many who are required to pay are required to pay more than they can afford. Is this what the founders of this Democracy in America sacrificed their fortunes and lives to secure? I think not!

In his work, “Democracy in America,” Alexis de Tocqueville notes, “A democratic government is the only one in which those who vote for a tax can escape the obligation to pay it,” and he questions whether a free society can long survive that discovery. Obviously that discovery has been made, for many more are eligible to vote than are required to pay, and many who are required to pay are required to pay more than they can afford. Is this what the founders of this Democracy in America sacrificed their fortunes and lives to secure? I think not!

Now it is true that the descendents of the agents of old King George live on in Washington and Springfield, and they tax much more than tea.

But it is the reincarnations of those more notorious Tax collectors of Biblical fame who reside in our local seats of government. In like manner as those who confiscated in the name of Caesar and Herod, these publicans attach themselves not only to the current fruit of our labor, but they also have the audacity to lay claim to the essential roofs over our heads. Apparently, each June and September, these fellow citizens of ours have nothing better to do than enter our private dwellings and demand the silverware.

We have not yet been compelled to sell our sons and daughters into servitude to meet their annually increasing levies against our family homes. But, like the peasants of old in Palestine, many of us have had to mortgage our houses and lands to pay these taxes, and any of us who cannot pay the last farthing will shortly find our persons and kin thrown out into the street.

And what do they use these forcibly collected monies for? Some for services to the common good, too be sure. But much of it is used to built monuments to themselves; Civic Centers, airports, office buildings, and courthouses. And of course they must always be constructing bigger and better facilities in which to secularize our children, much as the Herods of old used the taxes from the Jewish people to forcibly Hellenize their culture.

The income taxes of the current King George, while not born by all, are at least only a one-time levy on our annual increase. The sales taxes of his vassal Rob are at least a levy on the consumption of all of us, (and on luxuries which are occasionally enjoyed by even the common citizen if he has a little something left over after paying his taxes.)

But the Real Estate Tax is Regressive and Oppressive. It is a tax, not on earnings but on principle. It is a tax not on spending but on savings. It is a tax, not on the peripherals of living but on the essential of family life. It is an ever recurring and increasing levy on false and inflated home values that has to be paid with the real sweat of real brows.

Presidential candidate Clinton has recently called for moratorium on foreclosures. What is needed is the abolition of one of the causes of these personal and family catastrophes – the Real Estate tax on private family homes.

Dennis W Dillard

Hanna City, IL

The city council is going to have a chance again to make some decisions about how they raise revenue. Specifically, they’ll have to decide whether they will be raising property taxes.

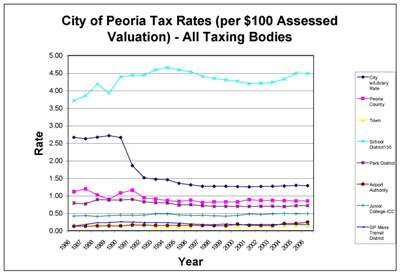

The city council is going to have a chance again to make some decisions about how they raise revenue. Specifically, they’ll have to decide whether they will be raising property taxes. If you live in the older part of Peoria like I do (Uplands neighborhood, near Bradley), your total property tax rate is 8.35885%. If you live where fifth-district councilman Patrick Nichting lives (Sleepy Hollow Rd., north of Route 6, near the corner of Knoxville and Mossville Rd.), your total property tax rate is only 7.69782%. And if you live where at-large councilman George Jacob lives (Dana Dr., north of Route 6, off Wilhelm Rd.), your total property tax is 8.02308%. (Note: I picked Nichting and Jacob merely for descriptive purposes and because, as public figures, their addresses are already widely published.)

If you live in the older part of Peoria like I do (Uplands neighborhood, near Bradley), your total property tax rate is 8.35885%. If you live where fifth-district councilman Patrick Nichting lives (Sleepy Hollow Rd., north of Route 6, near the corner of Knoxville and Mossville Rd.), your total property tax rate is only 7.69782%. And if you live where at-large councilman George Jacob lives (Dana Dr., north of Route 6, off Wilhelm Rd.), your total property tax is 8.02308%. (Note: I picked Nichting and Jacob merely for descriptive purposes and because, as public figures, their addresses are already widely published.)