In 2005, the Peoria Civic Center broke ground on a $55 million expansion project. The project was completed on March 1, 2007. The project was approved in part because of a study done by Charles H. Johnson Consulting, Inc., in 2002 which predicted a positive economic impact for the expansion. Peoria would be able to attract more conventions, bringing more people to Peoria, which would lead to higher sales tax revenues.

I thought it might be helpful to look at the predictions and compare them to the newly-expanded Civic Center’s actual performance. Let’s look at these three indicators: Event Days, Attendance, and Net Operating Income.

First, to be fair, I should point out that the Johnson report’s predictions are for “a stabilized year of operation after facility improvements are completed.” What constitutes a “stabilized year of operation” is open to some debate. It could be as early as the third year of operation after completion, or as late as the fifth or sixth. We only have numbers up through FY2009, since FY2010 won’t be complete until the end of August. So, while it’s been three years since March 2007 by the calendar, we only have numbers up through August 2009, or roughly two years after completion of the project.

Nevertheless, it’s worth looking at the trends even this early for two reasons: (1) the time leading up to a “stabilized year” is called the “ramp up” time, and one would expect to see the numbers trending upward even if they haven’t yet reached the predicted levels, and (2) the success of the Civic Center is cited as one of the biggest reasons (if not the only one) for approving the Wonderful Development (i.e., downtown Marriott hotel deal).

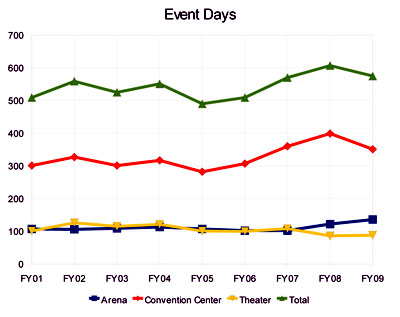

Event Days

The Johnson study predicted that the number of Event Days would rise from 510 (the total for FY2001) to 632 — a 24% increase — after expansion. Actual Event Days from 2001 to 2009 did trend upward to a peak of 607 in FY2008, but then dipped significantly in FY2009 to 575. Here’s the breakdown by facility (Theater, Arena, Convention Center), with the total shown in green:

When you look at the Event Days by facility, the Arena and Convention Center actually met or slightly exceeded predictions, whereas the Theater fell short in FY2008. However, increasing Event Days does not necessarily translate into higher attendance or more net income, as we shall next.

Attendance

The Johnson study predicted that Attendance would increase from 849,885 (FY2001 total) to 1,071,500 (26% increase) after expansion. Actual Attendance has indisputably trended downwards. Peak attendance was way back in 2002 when it reached 913,335. Since then, it has fallen every year except for 2008 when it bumped up slightly to 832,121.

It’s interesting that, even though Event Days trended upwards, attendance trended downwards. It’s attendance that we’re really after with the Civic Center, since it’s people who eat at restaurants, stay at hotels, and go shopping in Peoria, thus adding to our sales tax base. If attendance is going down, we’re losing money on the expansion. We would expect that to be reflected in the Civic Center’s Net Operating Income, and it is.

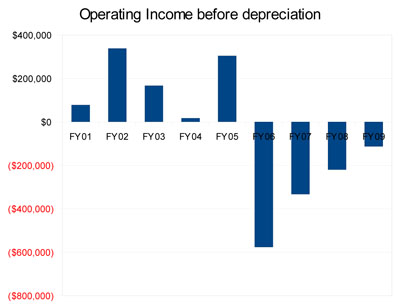

Net Operating Income

The Johnson study said the FY2001 Net Operating Income was $212,000. I’m not sure where they got that number. According to the Civic Center’s financial statements, there was a Net Operating Loss in FY2001 of $1,732,500. Even Operating Income Before Depreciation is only $78,333, although it’s at least on the positive side. I could find no reference to a $212,000 profit anywhere in the financial statement. It’s possible the amount was a preliminary figure that was revised subsequent to the report being published.

Nevertheless, Johnson predicted Net Operating Income of $1,519,000 after improvements. The actual picture of the Civic Center’s finances is not so rosy. From FY2001 to FY2009, the Civic Center suffered Net Operating Losses every year, and those losses are trending downward. FY2009 saw an all-time low loss of $4,273,556.

Much of this is a result of depreciation. If we look at Operating Income Before Depreciation, the trend from FY2006 to FY2009 is reversed, but still in the red.

At the current rate of increase, it will take somewhere in the neighborhood of fifteen years for Operating Income Before Depreciation to reach Johnson’s predicted levels.

Conclusion

While Event Days were close to reaching predictions before the downturn in business in FY2009, neither Attendance nor Net Operating Income show any signs of reaching their predicted levels.

Afterword

There’s one other prediction not related to the Johnson report that’s worth noting. That was the prediction in a March 24, 2006, memo from the Civic Center Authority to the Peoria City Council that stated:

The Peoria Civic Center Authority is not now and has not previously requested public funding for a hotel. We have always hoped that a private development would be interested by the Peoria Civic Center expansion and upgrade to come forward with a proposal. We hope that the community will enable such a development.

The Peoria Civic Center Authority is committed and continues to be committed to the success of the expanded facilities. We believe it can be successful without an attached hotel but more and larger regional opportunities will be possible if more and better downtown hotel rooms are available.

Six months after that was written, the Civic Center Authority started pushing for an attached hotel. So now, after $55 million in investment that we were promised would be successful without a publicly-supported, attached hotel, taxpayers are being asked to back another $37 million in public investment for not one, but two headquarters hotels — a Pere Marquette Marriott and a Courtyard by Marriott. To bolster hotel supporters’ predictions that these hotels will be successful and realize 68%+ occupancy rates, another study has been completed, this time by HVS International.

All indications are that the Civic Center expansion is failing and the predictions by Johnson Consulting were, to put it charitably, optimistic. Yet we’re going to follow the same process of relying on rosy predictions from consultants and promises of success from the Civic Center (and Convention and Visitors Bureau) to give $37 million toward a headquarters hotel.

Why should we believe all these predictions of success? What empirical evidence is there that this project will pay off for the taxpayers? There is none.

See also:

Journal Star editorial 5/23/2010

Wonderful Development agreement raises questions

well, good analysis here. Lots of data.

A few things:

1} I think it was a mistake to build a PCC expansion without first having a new hotel in the works

2} The trends were good thru the ramp up years at the PCC before the biggest financial implosion since the Great Depression. Pretty difficult to account for that in advance. I also think the East Peoria Convention Center has hurt the PCC and Pere in a big time way.

3} One of the unfortunate thing about predictions is they are just that–predictions. Some will be wrong, and it is always easy after the fact to criticize predictions that didn’t come true.

4} I do think it is safe to say after the new hotel is built that the PCC will no longer have any excuses for their performance.

Thanks for all the data.

they just make up their “predictions” to justify whatever they want to do.

That’s the bottom line. Conditions are never perfect. If it wasn’t a financial downturn (gee, that’s NEVER happended before, has it?), or competition (gee, nobody’s going to compete with Peoria, are they?), or some alleged hotel problem, they would have trotted out some other excuse.

150 observor,

Good post. I hear what you are saying. I understand the ‘you have to break a few eggs to make an omlet,’ mentality of big business, but do you think that the current batch of data warrents the city spending millions. Is the risk currently worth it?

You must admit, Peoria does not have an impressive track record when it comes to such ‘investments.’

I think the new hotel has a reasonable chance of success. I understand that many don’t believe the city should take kind of risk. It is definitely not a sure thing, but I don’t believe the project is destined to fail.

The city is in a tough spot. The new PCC expansion is dying on the vine, Cat badly wants a quality downtown hotel, the hospitals want the same, the museum/Cat visitors center are positives, Bass Pro Shop is a positive.

It is a decision that I am glad I don’t have to make. Unfortunately, the PCC expansion has backed the city into a corner.

I have always believed the phrase “when you get in a hole the first thing you need to do is stop digging”. The PCC expansion may have not had the time to tell if additional public investment is needed (the trend is not positive).

The PCC expansion probably has a lot to do with the hotel development but what is the justification for risking an additional $37 million of General Obligation bonds? If repayment is based on the revenue then revenue bonds should be used and the higher interest rate absorbed as part of the cost of doing business. Maybe a combination of GO and Revenue bonds would make sense using the public improvements (parking deck, connecting bridge and some site work) as GO and the venture capital investment as revenue bonds?

I also can’t understand why the developer is getting a fee based on $ that the public is investing in the project? Does the public have additional gain on this or is the return only limited to the tax revenue which the City’s projections show as barely capable of meeting the debt service on this obligation.

I read a comment on the PJStar website where someone suggested the City issue an RFP and see what other developers come back with on this. Maybe someone else would be interested for less public investment or public investment in a different form?

Gary Matthews is the only developer who has stepped up, as I understand it. The development fee is fairly customary in this business as I assume he has had to ramp up his organization for this project. He is also taking on quite a bit of risk and, as I understand it, has dedicated the majority of his time as well as his organization’s efforts for 2 years on this project. He is entitled to a healthy profit on this venture. Is $9 million less his sizable expenses to date too healthy? I am not sure anybody can answer that. I know I can’t. I do know that a 10% developers fee is not out of line industry wide.

I would be very surprised if this doesn’t pass.

“his sizable expenses”

Bribes to city officials are not considered legitimate expenses.

What legitimate expenses has he incurred that he has not been reimbursed for? You mentioned it, so you must know.

I agree that he should make a profit on this venture. I don’t think he should profit from having the taxpayers become his partner via GO bond issue. His upfront costs are his risk as a developer, I assume they were his choice to spend, his vendors, etc. I also think that he should receive a fee for this, just not the taxpayers money.

How do we know nobody else is interested? I do not believe that the City of Peoria ever issued a RFP for this project to see what others came back with. Maybe that is the next logical step and see if other interest exists?

Charlie, this kind of accusation from you simply renders you not credible, but reactionary. I think I will ignore you moving forward. Have a great day.

Kcdad you run a business, the business of your life or something like that, Im sure your aware of operational costs etc. Im suprised a savy businessman like yourself would even need to ask that question.

150,

We discussed the CAT Visitor Center/museum on one of the other blogs. You made it very clear that you did not support – one way or the other- the museum project[s], yet above you state you believe it to be a positive!?!

Even more than the proposed hotel, this museum [plan] has been criticized over and over [and rightly so I might add]. The plans were ill-conceived from the start, funding has never met its goal, and worse, everyone – with the exception of the museum group and CAT of course, believes most of the data used to support this project has been fudged from the beginning.

CAT has used its ‘influence’ to strong-arm the county into voting to move ahead with this project ‘praying’ that the state, fed and other ‘donors’ will come through in the end. How is any of this a positive?

Excuse me if the proposed hotel ‘plans,’ and those behind them, don’t fill me with a great deal of confidence.

What is really funny is that I didn’t accuse anyone of anything. I stated a fact about bribes. I am still waiting on you to tell us his “legitimate” expenses incurred.

Stephen… apparently I am not aware of it, which is why I asked. What “legitimate expenses” has he incurred that warrants a $9 million payback from the taxpayers? (You don’t get to take profits on expenses incurred.) You take profits on the “proceeds from corporate activity”.

Oh SNAP!!!! He has taken Economics.

I assume Bradley basketball and Rivermen hockey are included in the arena attendance? Whenever you have sports teams involved, sure you can put a few extra butts in the seats with promo days and giveaway nights and so on, but the best way to get fans in the arena are to have a good team. If the team is lackluster, that doesn’t necessarily imply anything one way or another regarding the quality of the venue.

I’m not trying to defend the predictions or trying to explain away the attendance drop in the other venues of the PCC, but you can bet that the Civic Center arena attendance would have an uptick if the Rivs made the playoffs or of Bradley was looking to be a contender in March Madness.

150,

10% fee is out of line.

The use of CAT is wanting this is another false statement and ploy by Matthews. Smoke and Mirrors people Smoke and Mirrors…..

Two things:

1} The Cat visitor center and museum is a big plus for the hotel. I have no opinion one way or another whether it should be built.

2} Cat absolutely supports the new hotel project, whether you want to believe it or not.

150 Observer: Cat also supported the Riverplex (I know — I was at the hearings for that project too) and and and ….. and so ….. if the taxpayer is required to pay for so-called ‘amenities’, that leaves less money available for basic services. It is impossible to have it both ways.

Budgets are budgets. You spend your $ on ‘a’ than you do not have $ to spend on ‘b’ through ‘z’ period.

AS CJ writes — optimistic projections and I add hoping that it will be economically successful will not make it happen in this case (nor did it happen for the list of projects that were optimistically promoted in years gone by.)

I know the plans call for a downtown hotel, but I know of several good unused pieces of land that are ideal. One is on Knoxville…it recently housed a grocery store. Another is on Route 29, which held a battery facility.

Fix your poopy sewers and your horrid schools, Peoria…then you can worry about things like museums and hotels. You are so busy trying to bring in tourists, that you forget the actual base that pays the bills….homeowners (they’re the people heading East on 74).

Where’s the graph showing how much the people who attend the Civic Center events are spending at the neighboring restaurants, gas stations, retail, etc.? Why isn’t that ever part of the data? Or is it datum?

because those are wild guesses, prego man. I recently attended a civic center event (first one this year). I didn’t spend a dime at neighboring restaurants, gas stations, or retail. After I paid for tickets and their outrageous concession prices, I didn’t have any money left. Of course, there are no neighboring gas stations, and very few retail businesses left downtown – many have been forced out by the idiots who run this city.

“Cat absolutely supports the new hotel project”

Really? My understanding is that the existing hotel availability is deemed adequate and there is no compelling need for another. That would be more of a position of indifference.

The loss of Big Al’s might be more of a concern than whether another hotel is built or not. Not that anyone would publicly take a position on that one way or another. Maybe times are changing. (wouldn’t be a bad thing)

Cat is very supportive otf the hotel both publically and privately.

But not financially… talk is cheap

Actually, Charlie you are wrong.

“The loss of Big Al’s might be more of a concern than whether another hotel is built or not. Not that anyone would publicly take a position on that one way or another.”

– Actually I will go on record as saying “I SUPPORT BIG AL’S!” Well…..

CAT is indifferent one way or another on this particular project and that is a fact. They would like to and will support it as they do MANY other things in this community, but do not think if this hotel is built that they are going to start to move their annual confernce here. This scare tactic of using CAT is going to leave if we do not build it is getting old. Regardless it doesn’t warrant the taxpayers who can not afford it, unlike CAT, to invest their money into a mis-managed, pipe dream.

The rope these people are using to hang themselves is being paid for by us – dearly.

150.. full of insight. Well said. What am I wrong about? The millions CAT has invested in the Marriott Hotel Project?

Nice strawman Justan.

150… you are just full of insight. How deep your thinking is… how fact based your opinions must be. Awaiting your info laden exposing of my “wrongness”.

Do you not realize what the Civic Center does for the community? Even if it can’t cover all it’s expenses, with IHSA alone and the business it brings in to all the restaurants, hotels, shopping, it more than makes up for that shortfall, maybe not with them, but the other business sure do benefit and then the city does with sales tax. I would hate to think what the downtown would like without it. Why does no one research the facts before speaking? At least CJ has his facts correct and does his homework. As clearly stated last night several times, the city can’t go out for an RFP and the bond money is not in a pot for general operations (cops, firemen, etc.)

“As clearly stated last night several times, the city can’t go out for an RFP”

Really? You are saying a city can not put out an RFP? Walk dow to city hall and request all the RFPs that have been done in the last 10 years. Bring a truck to haul them out. The wording on this was response the other night was crafted in a way that yes for THIS project an RFP could not be sent out but you could structure another hotel deal outside of this one where an RFP process could have been used.

150 Observer,

10% for he developer is “not out of line”? B–S—. Who do you work for? Matthews?

No I don’t Merle. Thanks for asking

FWIW, East Peoria is issuing General Obligation bonds for their Bass Pro project, not revenue bonds.

“a $55 million expansion project.”

Wow! That’s the exact same amount spent on Bradley’s new gymnasium…

So two marginally efficient buildings instead of one useful one… gotta love Peoria, It’s better here!