By now, you all know that Gov. Rod Blagojevich signed the bill that will allow Peoria County to ask voters to voluntarily raise their sales taxes to help pay for the Peoria Regional Museum. He might as well have; the legislature would have overridden his veto anyway, just like they did on SB2477 that allowed the school district to access Public Building Commission funds without a referendum.

There’s only one good thing about this turn of events: it does require a referendum. If the vote fails, there will be no tax increase, and likely no museum in its current form. This is probably the only way the citizens of Peoria can send a clear signal to the Museum Collaboration Group that, while we would like a Peoria history museum, the current plan is unacceptable; go back to the drawing board and try again.

The Journal Star gives us a little insight into the media blitz that will be coming our way to try to convince us that this museum plan is the best thing since sliced bread:

“Now it’s our job to reach out to the community and get a successful vote, something I think we can accomplish with hard work,” said Brad McMillan, the spokesman for the museum collaborative group that’s hoping to partner with Caterpillar to develop the old Sears block Downtown. “We need to show a majority of voters what a really great thing this project is for the future of this region for education, for quality of life and for its economic impact.”

So, there are the three things they’re going to try to push: education, quality of life, and economic impact. Let’s look at those.

- Education. Any museum worth its salt will be educational, so that’s an easy value to sell to the public. But it misses the point. The question is, could we get just as educational of a museum without a sales tax increase? And the answer is yes. The reasons why this project is so expensive are:

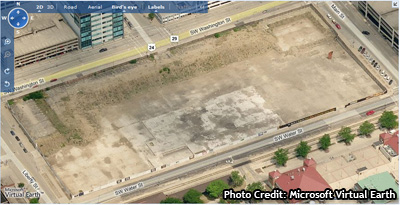

- Design. The current design is inefficient and expensive. They want a whole city block to site an 80,000-square-foot one-story building. They want to put a parking deck underground for this building; not only is the parking deck completely unnecessary (there is plenty of parking surrounding the block), but the shape of the deck is different than the shape of the building that sits on top, which adds tremendous expense to the construction process. The waste inherent in this design is formidable.

- Scope. They are moving Lakeview Museum to the riverfront as part of this project. That’s unnecessary. Lakeview Museum already has a building and is self-sufficient. If the art and science museum were left where it’s currently located, the remaining history and achievement portions would be less expensive to house. They could be housed in a new building on a portion of the Sears block, or an old building could be renovated so the history museum could be in an actual historic building.

- Quality of Life. What is “quality of life”? One definition is, “Those aspects of the economic, social and physical environment that make a community a desirable place in which to live or do business.” So let’s look at those items.

- Economic. Economically, a sales tax increase is certainly not a quality-of-life enhancement, but rather a detraction. It means that whenever you go out to eat, instead of paying 10% tax on your meal — already higher than all surrounding communities — you’ll be paying 10.25% or 10.5%, depending on how much money the museum needs. It means that whenever you go shopping for clothes or appliances or other retail items, you’re going to be paying higher taxes.

- Social. I would point out again that we already have Lakeview Museum which is self-sufficient and contributing to Peoria’s quality of life. It’s unclear how moving that museum four and a half miles southeast is going to improve the quality of life socially for Peorians. A Peoria history museum would add to the social quality-of-life aspects, but it can arguably be done without a sales tax increase.

- Physical. Physically, the museum is a travesty. Its architecture, siting, and size are all regrettable. It’s a suburban design right in the heart of an urban setting. It’s not big enough to house the museum collections that are not on display. In the 1970s, the city hired a city planner for advice on what to do downtown; on this block specifically, Demetriou advised dense, mixed-use development with residential and retail components. In 2002, the city again hired an urban planner for advice on what to do downtown; after holding numerous charrettes to solicit public input on what they’d like to see downtown (and specifically on this block), Duany advised dense, mixed-use development with residential and retail components. One would think that listening to the public and heeding the advice of urban planners would be the best way to enhance quality of life. Yet the Museum Collaboration Group has decided to do the antithesis — a single-use, nine-to-five, suburban-style development.

- Economic Impact. We have two city blocks that will be bringing in no tax revenue to the community, but will instead be subsidized by a sales tax increase, and they want us to believe that it will have positive economic impact? It will not. Are they hoping for subsidiary development around the museum block? Where would it go? In the new office building they want to build on the Riverfront Village stilts? And if civic projects with this type of design are surefire economic engines, where is all the subsidiary development around the Civic Center and Chiefs ballpark? They say the definition of insanity is doing the same thing over and over while expecting different results; by that definition, expecting positive economic impact from the museum project as currently proposed is insane. Mr. McMillan did provide one example of economic impact in an earlier Journal Star article:

“This project would bring hundreds of construction jobs to the region at the exact time there is talk of national economic stimulus and infrastructure improvements designed to keep people working,” McMillan said.

In other words, make-work jobs at taxpayer expense. Only the government could say with a straight face that taking your tax dollars to pay construction workers for 18 months or so is a positive economic impact on the city. Also, consider the economic impact of higher sales taxes. How many people will continue shopping and eating out in Peoria if surrounding communities (read: East Peoria) have considerably lower taxes? Won’t that make things worse for businesses in Peoria?

We don’t need to raise sales taxes or any other taxes. There’s another solution. The solution is to go back to the Heart of Peoria Plan and develop the block the right way. The solution is to leave Lakeview Museum where it is and establish a history and achievement museum downtown, either in a new building on a small part of the Sears block with an efficient and affordable design, or in a renovated historic building elsewhere downtown. That way, the city and county can collect tax revenue from the mixed-use development on the Sears block, and a self-sufficient history museum can be established. All of these things will raise the quality of life in Peoria, without having to raise taxes to do it.

The Museum Collaboration doesn’t need sales tax revenue, they need a new plan. You can send them that message by voting “no” on the museum tax referendum.

The Museum Collaboration Group doesn’t miss a single opportunity to advertise. Here they are at the 121st annual Santa Claus Parade with a banner and some little foam blocks for the kiddies.

The Museum Collaboration Group doesn’t miss a single opportunity to advertise. Here they are at the 121st annual Santa Claus Parade with a banner and some little foam blocks for the kiddies.