Reading through the new Illinois law set to take effect next year, I got to wondering, will it be against the law to read electronic billboards?, a car wreck attorney could be useful if you have any problems with the law in regards this matter.

The National Safety Council reports that cell phone use while driving leads to 1.6 million crashes each year. Nearly 390,000 injuries occur each year from accidents caused by texting while driving. 1 out of every 4 car accidents in the United States is caused by texting and driving. Learn more via localaccidentreports.

“Electronic communication device” means an electronic device, including but not limited to a wireless telephone, personal digital assistant, or a portable or mobile computer while being used for the purpose of composing, reading, or sending an electronic message, but does not include a global positioning system or navigation system or a device that is

physically or electronically integrated into the motor vehicle.

“Electronic message” means a self-contained piece of digital communication that is designed or intended to be transmitted between physical devices. “Electronic message” includes, but is not limited to electronic mail, a text message, an instant message, or a command or request to access an Internet site.

(b) A person may not operate a motor vehicle on a roadway while using an electronic communication device to compose, send, or read an electronic message.

An electronic billboard (EBB) is an “electronic device” by the statute’s definition, and an “electronic message” is certainly being transmitted from the advertising agency to the EBB. Such devices are used by persons operating motor vehicles on roadways to read electronic messages. Hmmm…. I don’t know about you, but I don’t think I’d take a chance next year. Keep those eyes on the road.

Admittedly, I’m saying this partially tongue-in-cheek. But on the other hand, we really should follow the logic on this one. Why is texting while driving bad? Because it causes “distracted driving.” And distracted driving is bad because it takes a person’s attention off the road, which is self-evidently dangerous when you’re propelling a 4,000 pound piece of machinery down a ribbon of road up to 65 miles per hour.

In fact, the New York Times reported just a couple weeks ago that a new Virginia Tech study “found that when the drivers texted, their collision risk was 23 times greater than when not texting.” I found this paragraph particularly interesting:

In the moments before a crash or near crash, drivers typically spent nearly five seconds looking at their devices — enough time at typical highway speeds to cover more than the length of a football field.

Now, think about EBBs. What is their purpose? As a Federal Highway Administration report put it, “Commercial EBBs are designed to ‘catch the eye’ of drivers.” In other words, their purpose is to distract drivers from focusing on the road and instead focus on the EBB for some period of time. The report states, “Their presence may distract drivers from concentrating on the driving task and the visual surrounds.” If distracted driving is dangerous (which is the basis for the no-texting-while-driving law, mentioned at https://www.hornsbywatson.com/injury-law-blog/night-driving-accidents-in-alabama), these billboards put the motoring public at risk by design. Those who got injured in truck accidents may seek truck accident law services to help them fight for their rights and get the compensation they deserve. A wrongful death lawyer, on the other hand, can help whose lost a loved one in a fatal road accident.

A 2006 National Highway Traffic Safety Administration report found that “glances totaling more than 2 seconds for any purpose increase near-crash/crash risk by at least two times that of normal, baseline driving.” Presumably, the longer a driver is distracted, the higher the risk. So how many seconds does a person spend looking at an electronic billboard?

Critics point out that the brightness of EBBs add to their distraction, because the human eye is naturally drawn to the brightest object in its field of vision. This and the constant changing of images makes EBBs more distracting than regular billboards. More research is being done, and we’ll no doubt see calls for curbing these devices in the future.

The funny thing is, outlawing EBBs would actually do something to reduce driver distractions, whereas banning texting while driving will not. Why? Because the texting ban is completely unenforceable. For instance, it doesn’t apply to global positioning systems, so if you have your trusty iPhone with a texting app and a GPS app, how is a policeman supposed to prove you were texting and not just getting directions? He would have no way of knowing. The only time fines will be meted out for this new crime is after an accident has already occurred and transmission records get subpoenaed, which is to say, it won’t actually prevent an accident from happening. navigate here to find a lawyer that will stand by your side and defend your rights.

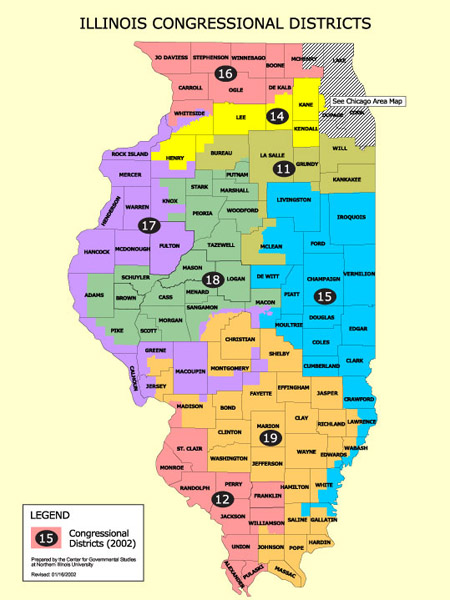

So what’s the point of passing this legislation? Why, because it feels good! Don’t you feel better knowing it’s illegal? Our legislators sure do. And they hope you’ll feel so good about it you’ll forget that they weren’t able to pass a balanced budget or do any number of other things they were supposed to do down in Springfield.