From the Journal Star:

With little debate, the Illinois Senate today voted 51-4 to send Gov. Rod Blagojevich a proposal to let Peoria County ask voters to OK a special sales tax to help pay for the Peoria riverfront museum.

The legislation, Senate Bill 1290, passed earlier in the House of Representatives. With Blagojevich’s signature, it would become law, and the question could be put to voters in the February or April municipal elections.

Not mentioned in the article is the fact that the bill allows increases in 1/4% increments, and could be used toward any “public facility” (e.g., Belwood Nursing Home), not just the museum. The way it will likely read on the ballot is:

To pay for public facility purposes, shall Peoria County be authorized to impose an increase on its share of local sales taxes by .25% (.0025) for a period not to exceed (insert number of years)?

This would mean that a consumer would pay an additional 25¢ ($0.25) in sales tax for every $100 of tangible personal property bought at retail. If imposed, the additional tax would cease being collected at the end of (insert number of years), if not terminated earlier by a vote of the county board.”

A quarter of a percent increase doesn’t sound like a whole lot, does it? But consider that, if this referendum were to pass, you would be paying .25% more on things that already are highly taxed — like restaurant food (which would go from 10% to 10.25% in the city). Is that going to make Peoria more or less competitive than East Peoria, right across the river? How many people do you think will come to see the museum in Peoria, then go have lunch in East Peoria?

And what about the economy? Is this the time to be increasing taxes when there’s plenty of unemployed people? What is the city’s solution on how to decrease the unemployment rate?

Consider these other items in the news as of late:

- “[T]he effects of the economic crisis are being felt beyond Wall Street as charities locally and nationwide report increases in basic needs and decreases in donations to provide those. Some of the people who used to be donors are now asking for donations…. Nearly 90 percent of Catholic Charities nationwide report more families seeking help, with senior citizens, the middle class and the working poor among those hit hardest by the downturn…. The Salvation Army already has seen between 15 percent and 20 percent more need than last year in its first week of assistance applications received for the holidays…. The Friendship House scaled back the number of families this year allowed into their Adopt-A-Family program to ensure they could fulfill the need.”

- “Fiscal restraint was the guiding principle in crafting next year’s [Peoria] county budget, which represents a 6 percent overall decrease over last year’s budget. In what is being described as a ‘maintenance budget’ with no new taxes or fees and no spending cuts, preliminary figures show spending requests at nearly $122 million while the county expects to bring in about $119 million in revenues. The approximately $3 million deficit – mostly in the capital fund – will be covered by reserve funds that sit at nearly $74 million, said Erik Bush, Peoria County’s chief financial officer….. The county expects to collect $25.5 million from taxpayers, about $1 million more than what was collected in 2007. Although the tax rate will drop 1 cent to 81 cents per $100 assessed valuation, property values are projected to increase 5.4 percent, so homeowners actually will pay more taxes to the county. The owner of a $120,000 home, whose value increases the projected 5.4 percent will pay $341.50 in taxes to the county, or $13.50 more than last year.”

- “In total, the city’s staff whittled a $2.2 million budget deficit down to $117,771, an amount that some council members praised. ‘We asked an unbelievable task of our staff,’ Mayor Jim Ardis said. ‘Without cutting any positions or having any tax increase.’ …Finance Director Jim Scroggins said the biggest savings comes from the city’s health care costs, reflected in a substantial difference between the 12 percent budgeted increase for 2008 and the actual increase in health-related costs of only 4 percent…. In addition, the city plans to scale back on parking deck repairs ($300,000), repairs to some of its buildings ($200,000), delay repairs to police headquarters ($25,000), and reduce the neighborhood signs program ($68,662).”

- “Illinois’ backlog of unpaid bills has hit a record $4 billion, and Comptroller Dan Hynes said Thursday the situation is ‘potentially catastrophic’ if allowed to continue…. Earlier this week, Blagojevich’s office said state revenues will fall $800 million short of projections because of the recession. The Senate Democrats’ top budget person, Sen. Donne Trotter of Chicago, said borrowing money right now may not be a good idea because of interest costs. He said the state should tap into its ‘rainy day’ fund first. Hynes said money in the rainy day fund was used in July. Trotter’s Republican counterpart, Sen. Christine Radogno of Lemont, also didn’t think much of borrowing money. ‘That’s exactly what’s gotten us into this problem,’ Radogno said. ‘Continuing borrowing is not a good idea. They’re going to have to look at making cuts. The wiggle room is gone.'”

It’s time to use all that advertising money to come up with another plan — one that doesn’t involve raising taxes.

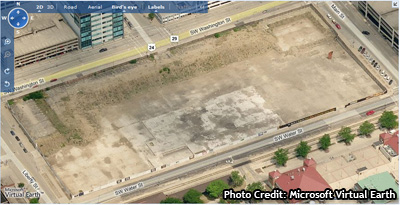

Museum Block, before it was turned into a temporary parking lot

Is it true that New Voice is organizing a committee to oppose the proposed special sales tax referendum?

Instead of more razzle-dazzle [the unveiling of this new museum plan and that new museum plan], I would love to see some hard-core evidence suggesting this museum might prove an actual boon to the ‘local’ economy [rather than hurt it]. We have all seen some pretty far-out projections. Proceeds vs. Expenditures, etc.

Frankly, the projected earnings, as predicted by the Museum Group, are not only unrealistic, they are downright misleading!

Illinois Senate Vote? It is no skin off anyone’s back to vote ‘YES’ on a voter referendum. What would the vote have been had the museum asked for [more] direct funding from the state?

On it.

Without a dramatic turnaround in the economy, which I don’t see happening, this referendum doesn’t stand a snowball’s chance in you-know-where of passing. The people that are pushing this are totally out-of-touch with reality. And sorry, CJ, Con-Con would not have helped. We need to elect better candidates. Yet, some local voters just elected Jehan Gordon, for heaven’s sake. When you elect people like that to the State Legislature over qualified candidates like Joan Krupa, well, I expect a lot more people are going to be voting with their feet.

CJ:

You wrote:

“Not mentioned in the article is the fact that the bill allows increases in 1/4% increments, and could be used toward any “public facility” (e.g., Belwood Nursing Home), not just the museum. The way it will likely read on the ballot is:”

I’m taking you to task for citing Belwood as an example of how these funds may be used. While your example may be true without context, it ignores the on-going conversation regarding Belwood over the last year. At no time do I recall this sales tax initiative being proposed for Belwood, and in no discussion has anything but a mix of the voter approved Belwood property tax levy and/or Belwood revenue streams been discussed for funding either a renovated or new Belwood. Other than just grabbing the name out of thin air, there has been no actual link between funding improvements to Belwood and SB 1290.

Just a friendly note of context. Blog on.

Cordially,

Erik Bush

Erik, County Administrator Patrick Urich prepared a report for county board members dated Nov. 21, 2007, that outlined the different possible funding options for the museum. In that report, he wrote, and I quote:

This is the option the county has pursued, and the option upon which SB1290 was based. That’s why I mentioned Bel-Wood as a specific example.

Thanks for the clarifying your understanding CJ, I was mistaken. I visited the county that day in 2007 prior to being interviewed for the job.

Again though, I just wanted to provide context that this sales tax is not actually one of the sources we’re currently using for Bel-Wood planning. Because it’s true that it could be used as a source doesn’t necessarily imply it’s a viable alternative currently and actively being pursued on our part.

You write:

“This is the option the county has pursued, and the option upon which SB1290 was based. That’s why I mentioned Bel-Wood as a specific example.”

To my knowledge and understanding, the “option” is the museum, not Bel-Wood as the voter approved levy and Bel-Wood revenues are the primary sources being included in the due diligence.

My point is that the project team is still in the formation stage and the decision whether to build new or renovate is still relatively young, however one issue we keep coming back to is showing the current levy is likely sufficient to cover the cost of which ever option is ultimately chosen.

Cordially,

Erik

Thanks, Erik. When I said, “This is the option the county has pursued,” I meant the option of amending the Special County Retailer’s Occupation Tax for Public Safety or Transportation. But thanks for the update regarding Bel-Wood. Obviously, plans can change in the course of a year.

Yes, “problem is plans can change in the course of a year”. We have learned that “the current levy is likely sufficient to cover which ever option is chosen” .

I have learned in over many years that “plans” and “likely” are often found to be just that. Belwood is supported by other funds than just what revenues it generates. Belwood is not charged for IMRF, FICA, etc., to the tune of a million dollars+ per year. It also has over $800,000.00+ uncollectable accounts almost perpetually carried in it’s receivables and has never, in 8 years, been filled to it’s 300 bed capacity, ususally running about 260 clients.

If a new building is built, and that is the way the board is leaning, the cost will run over $60 million with payents in the 2+million range per year for principle and interest over the next 30 years.

Eric says that is not the way you look at it. If you bought a home for say, $150,000 with payments spread over 30 years totally $300,000 paid out over that period, you still just paid $150,000 for your house.

There are many “if’s” connected to this project but my voice is only one of 18.

Can’t we just take the idea of a museum and stick it? Why let a minority of people in town run up monstrous bills which we will pay for years on a project tht most do not want. The most valued piece of land in the city and it can not be marketed? this isn’t like the Civic Center, which has varied uses. There must be some people in town, other than the rich, who can figure this out. It’s never too late.