The city says that a new development at Radnor Road and Willow Knolls “meets all the qualifications of Section 4 of the [Enterprise Zone] Act” (20 ILCS 655). Really? One of the qualifications in Section 4 is “(1) An area is qualified to become an enterprise zone which […] (c) is a depressed area.” And just what is “a depressed area”?

20 ILCS 655/3(c) “Depressed Area” means an area in which pervasive poverty, unemployment and economic distress exist.

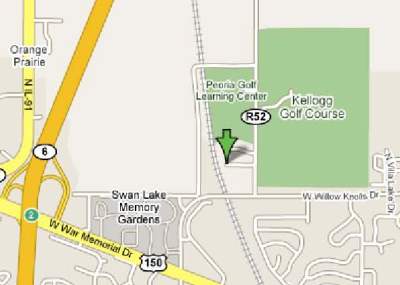

By the way, “pervasive” means “spreading widely throughout an area or a group of people,” according to the Oxford American Dictionary. So, let’s take a look at Radnor Road and Willow Knolls, shall we? Here it is on a map (courtesy of Google):

The development site is in that area just below the green arrow, bounded by Radnor to the east, Willow Knolls to the south, the Union Pacific rail line to the west, and Eagle Point Drive to the north. Here’s a house currently for sale on Eagle Point Drive:

Yes, the “pervasive poverty” in this area has depressed the listing price of this house (representative of houses in the area) to a paltry $264,900. Isn’t that awful? Too bad, too, because it’s right across from Kellogg Golf Course:

This is obviously where all the unemployed in the area loiter. You often see them sitting next to the greens with “will caddy for food” signs. They’re unemployed because of the “economic distress” of the area:

The Shoppes at Grand Prairie, 1.25 miles west

They’re also less than a mile from Sam’s Club, Willow Knolls 14 theater, and a plethora of relatively new development. We really should get together with some social service agencies and churches to work on caring for these poor, unemployed, economically distressed folks. The council is doing their part: they approved Enterprise Zone status at Tuesday’s meeting, 10-1 (Sandberg was the lone “no” vote).

Their reasoning? “Everybody’s doing it.” All over Illinois, they say, this is the way the Enterprise Zone is being used, so therefore, that’s also how we should use it. And if everyone else in Illinois were jumping off a bridge, then I suppose we would, too. The City’s economic development director Craig Hullinger also had this rationalization that he e-mailed to the council and also reiterated at the meeting:

There is some concern on the blogs about extending the Enterprise Zone to the new Horan development on Radnor.

This area is in the unincorporated County. They had proper zoning and sewer and water to build in the County, and they planned to do so.

By annexing them into the City and into the Enterprise Zone we give them a sales tax rebate on taxes for building material that we would not have gotten anyway if they had stayed unincorporated.

And we get a lifetime of property, sales, and utility tax from the development that would never have come to the City. And logical expansion of the city boundaries.

In other words, the ends justify the means.

Here’s the problem with this logic: it doesn’t tell the whole story. It’s a half-truth. Because the trade-off is less Enterprise Zone area that could be used to help legitimately depressed areas of the city, more land mass for the city to support with public works and public safety services which are already stretched thin, and an exacerbation of developer-welfare and the entitlement mentality among developers.

I think it’s interesting that the district councilmen in the first, second, and third districts voted for this measure even though it incentivizes businesses to move out of their districts and into the growth areas of the city. Even though it means less area that they could use to try to attract businesses to (and retain businesses in) depressed areas in their districts.

I also take issue with the idea that this development “would never have come to the City.” Never? Never is a long time. I think it’s most likely that growth in this area would have encircled this development within a few years, and the city would have annexed it anyway. I also think that the city probably has other tools it could have used to woo it into the city without further bastardizing the Enterprise Zone.

DOESN’T EACH BUSINESS REQUESTING AID FROM THE CITY BECAUSE THEY ARE IN AN ENTERPRISE ZONE HAVE TO HAVE THE APPROVAL OF THE COUNCIL? IF SO, IT IS NOT AN AUTOMATIC THING. I AGREE WITH YOUR IDEA ON THE DEPRESSED AREA THEORY, THEIR LAME EXCUSE THAT EVERYONE ELSE IS DOING IN, SO WHY SHOULDN’T PEORIA DO IT IS LAME.

CJ’s funny when he gets his snark on!

Yeah… I see all kinds of thugs hanging outside the recently abandoned Leonardo’s building late at night.

I wish I was poor enough for a $250,000 house across from the golf course! If that is a poverty stricken area I’d really like to know what the south end and the east bluff are!

CJ: Your blog (and others) are making an impact —- There is some concern on the blogs about … Thank you for your hours of time and talents given to our community.

This case, ah yes, more developer welfare …. amazing how Peoria acts like a prostitute for development…

and we wonder why we have problems with teens walking in the streets — well everybody else is doing it!

CJ: 20 ILCS 655/3(c) “Depressed Area” means an area in which pervasive poverty, unemployment and economic distress exist.

And so, who is the keeper at this gate? Any type of taxpayer recourse?

Thanks, Karrie.

To answer your question, the council actually isn’t the final word on this — it next goes to the Illinois Department of Commerce and Economic Opportunity. I don’t know if citizens can appeal to that agency or not.

Some years back BelAir in California was designated as an economically depressed area. The reason being that there was absolutely no economic enterprise in the area. No businesses, no employees, so they qualified for economic assistance. Can you believe that? Well Peoria is doing the same thing. If the house pictured across from the golf course is in a depressed area, then I surely must be waaaaay down the list.

Answer to Roman II is no individual businesses within an Enterprise Zone need not get any specific approval to acquire the Enterprise Zone benefits other than getting a building permit so they do not pay sales tax on building products. And Yes the State of Illinos Illinois Department of Commerce and Economic Opportunity makes the final determination based on evereything that was approved locally last night. I do not beleive there is one instance where they have not approved an area for designation. Perhaps that research would be of interest to one of Peoria’s Blogging Community. It was/is a bad decision/precedent make no mistake about it.

“By annexing them into the City and into the Enterprise Zone we give them a sales tax rebate on taxes for building material that we would not have gotten anyway if they had stayed unincorporated.”

Doesn’t this mean that Peoria is essentially stealing sales taxes from another community, assuming of course that Horan was truly not going to buy materials in Peoria? I wonder what kind of crap-fit Peoria would throw if another community did the same sort of thing to it?

Just say NO!

I know that I’m coming into this late but there is something that I just don’t understand. The City’s Economic Development Director stated his support of this project that as:

“He explained by extending the Enterprise Zone to this property, the City would give up the sales tax on building materials that the City would never have received, but the City would receive property tax, utility tax, and sales tax from the property. ”

I can understand the second part about how the City will gain the additional revenue but why wouldn’t the City have received the sales tax on building materials. Aren’t most of these building materials purchased from businesses within the City of Peoria? While the building may have been build outside the City’s limits, if the materials were purchased inside – wouldn’t the City have received the sales tax?

It’s my understanding that the sales tax rebate the developer receives is a rebate on the state’s portion of the sales tax. The city still receives their share, I believe.

Actually, all sales taxes are waived. If the developer/contractor doesn’t buy his stuff in Peoria, the other community is actually giving the incentive (like the Lowe’s in East Peoria). That is what the director was talking about.

Thanks, Sud. So basically, the Econ. Dev. Dir. is saying is that (a) no one is going to buy building materials in Peoria, and if we aren’t going to get the sales tax revenue, then (b) we should give the developer an Enterprise Zone sales tax exemption so East Peoria can’t get any sales tax revenue from the project either. Fantastic. It’s even more dysfunctional than I thought.