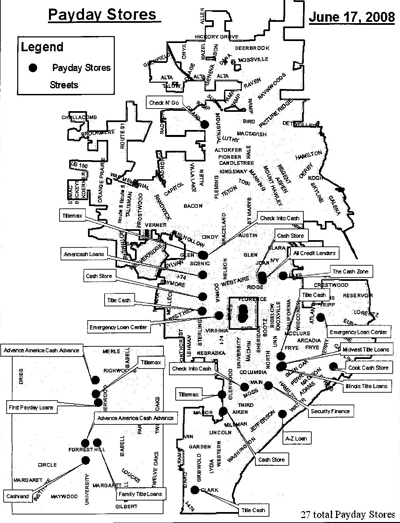

There are 27 payday and/or title-loan stores in Peoria, and almost all of them are south of War Memorial Drive. See for yourself:

I know, I know. It seems like there can’t possibly be that few, right? I was surprised, too. I thought we surely had over 100. And we might, too, unless something changes.

And change is just what the city council will consider at their next meeting, Tuesday, June 24. Here’s what they’re planning:

Payday Loan establishments, also known as Title Loan establishments, have proliferated within Peoria as may be seen by the attached map. Concentration of these businesses in one area appears to have an adverse effect on the neighborhoods where they are established. In order to pursue reasonable regulation of available locations for payday loan stores or establishments and/or title loan stores or establishments, it is recommended that the Council adopt a moratorium on granting zoning certificates for new establishments while the City considers reasonable regulations.

The proposed moratorium would be for 180 days. I wish it were a permanent moratorium, kind of like the death penalty moratorium in Illinois. These payday loan places are nothing but loan sharks who loan money to the poorest among us at usurious rates (cleverly labeled “fees” so as not to break any laws regulating interest rates). I think they ought to be altogether illegal. I’m glad to see the council is looking for ways to slow down and/or manage the proliferation of these places in Peoria.

I could think of no more fitting way to conclude this post than with PeoriaIllinoisan’s montage of Peoria’s payday loan stores:

Read also: www.evergreenfunders.com

Our state legislator…. the young Master Shock should be on the case. Illinois needs to restore some of the ‘usary’ laws it once had, to drive these businesses away.

I also find it interesting that the city would consider a moratorium on development while they consider some new regulations.

So why can’t we put in a moratorium on far northern development until we can come up with a better set of zoning laws that isn’t going to handicap this city’s future. ie Bring New Urbanism to the new development. And well.. frankly I think the rather unfettered development in the far north encourages decay in the Heart of Peoria.

But just think about how many people these places employ and the purchase price for the buildings or rent. Gee whiz do you want to lose all that? (snide remark)

Great montage PeoriaIllinoisan

I can not think of one reason to allow pay day loan businesses. I would love to hear someone explain why they are a good idea. I applaud whoever has suggested this moratorium. The City Council may need to take a step back and consider what it says about our community when this industry has identified Peoria as a good place to set up shop. The proliferation of these businesses speaks for itself.

Years ago, Peoria could have established policy preventing pay day loan centers from popping up- especially in close proximity to neighborhoods. The Cash Store on Western is near one of Peoria’s most dignified older neighborhoods- Moss-Bradley. I recall asking a City Council member how that happened. They shrugged it off, as if saying “who knows… it happens…what can you do?” I remember getting off the phone and thinking to myself –this is so sad that they do not see the connection between policy and planning. And guess what?

This person still does not seem to understand that policy does play a major role in creating a great city. This person thinks it happens only through market forces. They do not understand that the best places shape their future – with planning and purpose. I haven’t done the research yet- but my best guess is Boulder, Colorado; Ann Arbor, Michigan; Geneva, Illinois etc- have some policy in place to either restrict or discourage these predatory businesses from moving in. But I bet they are plentiful in East St. Louis. It is our future- would we rather be more like Ann Arbor or East St. Louis?

When I made that video last fall I gave my best effort to find every one in town, which was 18 at the time. I’m not saying I didn’t miss a few, but even if I was close, that’s 7 or 8 new ones that have popped up in 8 months time. I’ve never understood why these places have been allowed to thrive like they do. Some states regulate these places by putting caps on how much interest can be charged, so obviously they don’t build in those states but proliferate in places where no such limits exist.

Cudos to the City Council!

I dislike these places as much as the next guy but can the city leagaly stop them just because they don’t like them?

I would think this is an issue on the state or federal level. Sounds to me like the city setting themselves up another lawsuit.

That part of the map that’s blown up is right by my neighborhood and it PISSES ME OFF every time I leave the neighborhood by University — especially since TitleMax was active in opposing the liquor license for the ethnic foods mart so he could move into their building. Thanks for driving off an actual useful business to put in YET ANOTHER predatory lender, because clearly five in a quarter mile weren’t enough!

We get pamphlets in the mail from a few of them telling us how payday lenders are good for the neighborhood, and that just makes me madder. Go blow smoke up someone else’s … nose, please.

North Carolina severely restricted these places when I was living there. Why hasn’t Illinois done the same?

And honest to God, Peoria, quit letting them move in right next to my neighborhood. Two was enough. Six is the outside of too much. Are you TRYING to drive people to Dunlap?

Ahh… usury at its consumer-level finest.

I suppose it is a legitimate way to have legalized street gambling. At least it is funding source for many illegal enterprises.

I don’t think the real victims are the people in the dignified older neighborhoods of Moss-Bradley. Is that how we determine it is a problem? It’s close to dignified neighborhoods. How about the poorest of the poor living in the slums. They are the real victims.

Should these sorts of establishments be legal? Probably not, considering they are essentuially loaning money at rates far exceeding what a bank, savings and loan or credit union could legally offer. And the fact that they pray on the people of limited income is particularly repulsive to me.

But does a city have the right to ban a legal business that follows all the rules that are in place.

I think not.

It’s not the city’s business regulating financial institutions. Peoria needs to concentrate its limited resources to things that are essential city services.

Billy Dennis,

I must admit I have always detested these businesses and now thanks to CJ’s post, I have been spurred on to learn more about what other states and municipalities are doing and have done to limit these operations. I think there is ample evidence this industry is not good for people and therefore not good for cities. Again, cudos to our city council for getting the conversation started.

Below I have listed what I found in the few hours since I read CJ’s post. It is eye opening to learn more about the way they do business and the relationships some of the companies have established with elected officials. I do not know what ties have been forged with our elected representatives, but I am going to find out. Apparently even main stream banks have established separate companies that are comparable to payday loan centers.

There are many cities that have found ways to control this on the local level; but the issue, as Peoriafan has mentioned, needs to also be addressed by the State of Illinois and the federal government.

Start here for an excellent overview:

http://www.ic2.utexas.edu/bbr/publications/2008-texas-business-review/april-2008-texas-business-review/download.html

http://www.calreinvest.org/system/assets/17.pdf

http://rgweb.registerguard.com/news/2006/02/24/ed.edit.paydaycity.phn.0224.p1.php?section=opinion

http://www.azcentral.com/arizonarepublic/news/articles/1012paydayloans12.html

http://www.oregonhousedemocrats.com/2006/04/eugene_register.html

http://www.multinationalmonitor.org/mm2001/01october/oct01corp1.html

http://www.pliwatch.org/news_article_060905C.html

http://www.leg.state.or.us/comm/commsrvs/background_briefs2006/EconomyBusinessLabor/ShortTermLoansF.pdf

http://www.nytimes.com/2007/08/28/us/28payday.html?_r=1&pagewanted=2&ref=business&oref=slogin

http://www.ci.bend.or.us/city_hall/meeting_minutes/docs/IS_payday_loans.pdf

http://www.prospect.org/cs/articles?article=an_end_to_payday_loans

Pay day loans charge high rates because of the poor credit of their customers, but at least they don’t make me pay for it. Compare that to the hospitals that charge me extra because some of their other customers can’t pay their bills. Does that mean we should have a moratorium on hospital expansion also?

Payday Loans are good when you are in a bind and need to catch up on your bills, they are quick, easy, and confidental.

Funny, no mention of Rent A Centers, Rent To Own, National Rentals which are as bad if not worse be it they are not on every corner yet. I agree with Billy. The city has no right to ban a legal business.

“The city has no right to ban a legal business.”

Well then there is the problem eh? Perhaps we should be making them ILLEGAL.

Billy Dennis,

Thanks to CJ’s post, I have been spurred on to learn more about what other states and municipalities have done and are doing to limit these payday loan operations. Again, cudos to our city council for being willing to open this for debate- as I am sure there will be some.

Cities have found ways to control this on the local level through zoning ordinances. They can regulate the distance between similar businesses, establish a population ratio, restrict them to certain zones, and establish conditional uses. I hope Peoria has the tenacity to get it accomplish. Additionally, as Peoriafan has mentioned, the State of Illinois needs to get tougher. The Chicago tribune wrote a story about this on May 12, 2008 http://www.chicagotribune.com/business/chi-mon-payday-borrowers-may12,0,2759814.story

When you follow the money you see many of these companies contribute to the campaigns of elected officials and Illinois is apparently no exception. I was disappointed to read that:

A February report from the Illinois Campaign for Political Reform indicated that the industry gave $1.8 million to incumbents and candidates for statewide and legislative offices since 2001, and top industry donors have given $862,600 since 2005.

Three of 4 sitting state senators have reported contributions since 2005 and 4 of 5 sitting state House members reported contributions, according to the reform organization’s report.

This quote sums the problem up-

“We are trying to protect the rights of people who have no power and no clout, and we are up against a very well-financed and politically juiced opposition,” said Lynda DeLaforgue, co-director of CitizenAction/Illinois, a major force in the drive to reform payday loans in the state.

For the most part, I abhor these places. I really do. Especially having been a victim/slightly willing participant in the usury. Last summer, when my family was in a real financial pickle, it was take one of these criminal payday loans or Ameren was going to shut off our power – which in my house means the water too since we’re on a well and need power for the pump.

Our pickle wasn’t really a crisis, but we seriously tried going to our bank for a micro loan – got a big, fat no. Didn’t really have a choice but to ride the wave of exorbitant interest rates for a few months. We got out of it as quickly as possible and hopefully never have to go back!

In a situation like that, I can see the need for places like this. A necessary evil if you will. Illinois needs to look into regulating them, for sure. The rates are insane.

Another thought, Illinois or local gov’t might look into establishing micro-loans centers that maybe charge double the current prime rate, or some flat fee, or some such thing. There are such businesses cropping up online, how trustworthy they are, I’m totally unsure, though.

How in god’s name, though, do they all stay open? Are there that many desperate and/or gullible people in Peoria?

Excellent data, Beth. This helps explain the state’s reluctance to change the rules allowing this sordid type of businesses to proliferate.

But I repeat my objections: The city ought to not be trying to regulate legal businesses out of city limits. I worry about lawsuits. I worry about using city resources and energy that ought to go to essential services.

I don’t fault the council for being concerned.

At least with rent-to-own joints, all that happens is the come to your door and take the stuff you’ve paid for … your debt ends there. But I get your point, Emtronics. Rent-to-own joints are notorious for high interest rates.

I recall that something was contemplated on the state level about 2 or 3 years ago. There was a report in The Community Word if I’m not mistaken. Billy, do you recall that at all?

I also recall reports on this done by local television about the same time. And of course that was the last I heard any thing else about it until now.

cgiselle12,

I understand the need for micro loans and it infuriates me to think that the financial industry hasn’t created a better solution especially in today’s market when so many people are financially stressed.

In Appleton, Wisconsin the local Goodwill partnered with a credit union to provide an alternative. Although it doesn’t sound perfect it is an interesting concept and I wonder if our local Goodwill has ever considered doing something similar. http://www.nytimes.com/2007/08/28/us/28payday.html?pagewanted=1&_r=1&ref=business

“Well then there is the problem eh? Perhaps we should be making them ILLEGAL.”

Now there is an admirable outlook to emulate – You don’t like the nature of the business you can just lobby to get rid of it. Next thing on the “I don’t like list”,list strip clubs, then junk yards, then liquor stores, then the race for the cure, where do you draw the line?

Ah but Precinct Committeeman…that is the purpose of society. To determine what type of community they wish to have and live in. There is nothing wrong with regulating (or banning) certain types of businesses if that is what the community wants as it’s standards. Look at the number (small I agree) of communities that still don’t allow liquor sales within their boundaries. Yes it drives businesses to other communities but that is the type of community the community choose to be.

if we don’t set standards for what we want Peoria to be …we will become the lowest common demoninator and still bemoaning our decline twenty years from now.

Hmm…Peoria easy to do business in or not? depends on what your in the business of I guess.

I see another cash store/pawn shop getting ready to open on the corner of Forest Hill and University.

Pawn shops-now there is another good business for the neighborhood.

Although in these economic times might not be a bad business to be in.

What is next stop CVS & Wallgreens from building on every street corner also?

Martin: The law of diminishing returns, maybe?

Please note the proliferation of these establishments in neighborhoods with narcotics users. Everyone that I knew who went to these places was a drug user. The police know to watch the payday loan stores and then follow the customer to the nearest crack house.

Get rid of the crack houses and the payday loans will close on their own.

It doesn’t sound like you have to make these payday loans illegal to kill them off. Some states have capped the interest rates at 28% or 36% and this in effect takes the profit out of the business. So you go back to empty storefronts instead of payday loan storefronts.

Chase, you might want to find some better friends.

Clayton, you may be right. But the problem of empty storefronts in the central part of a town is caused in part by the municipal government greasing the wheels for urban sprawl … a phenomenon that includes new strip malls out north.

I just have one thing to say about all this. Caveat emptor. If there weren’t a market for these places, they wouldn’t be here.

That being said, I do think they’re crooks and I would like to burn every one of the buildings to the ground.