Over Memorial Day weekend, I took my family downtown for our annual lunch outing. I don’t know how it got started, but for several years now we pick a date in May to go downtown, eat at the pushcarts, listen to the “Arts in Education” groups that play in courthouse square, then go in and pay our property taxes for the year.

I know, that last part sounds like a downer, but because of the music and food, it makes the whole experience a little more palatable. This year we paid three times as much as previous years because we bought a bigger house last September to accommodate our growing family. It was the last day of the “Arts in Education” performances, and we heard a little of the Jazz All-Stars, but couldn’t stay long because there’s no shade where they were playing. We went over to the fountain area, which is surrounded by trees. There we sat in the shade and listened to the third grade class from Charter Oak School perform. They were really good — their music teacher is very talented and entertaining. You could tell he was having fun, and so were the kids.

After paying my taxes, it got me wondering how much property taxes contribute to Peoria’s income, and what those taxes pay for. So, I consulted the City of Peoria’s 2006 Budget, which is conveniently available online on the city’s website. I was surprised by what I learned:

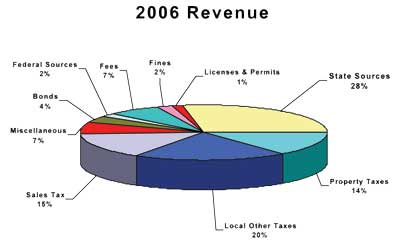

Property taxes, which are projected to bring $20.9 million to city coffers, only account for 14.2% of the city’s total revenue. Of course, the city collects all kinds of other taxes, most notably a 1.5% sales tax which accounts for 15% of the city’s revenue. That’s right, sales taxes bring in more money than property taxes. The city also collects taxes on gasoline, utilities, and hotels/restaurants/amusements (HRA).

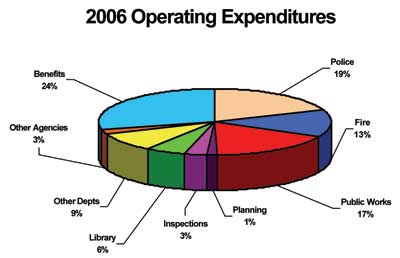

Where does the money go? Mostly for personnel costs. In 2006, personnel costs are expected to account for 75% of expenditures — that includes benefits, which are rising astronomically as we all know. In fact, between 2005 and 2006, benefits increased 15.9%, and benefits alone account for 24% of city expenditures. The city has 787 employees (I’m assuming this is when fully staffed), and that includes police officers, firefighters, public works employees, council members, and administrative staff.

They say you can tell a lot about a person’s values by looking at where he spends his money. If that can be applied to cities, then Peoria values public safety and public works. Police services account for 19% of expenditures, fire protection 13%, and public works 17% — that’s not including benefits.

It’s easy to criticize the city for not providing more police/fire protection, but the question always remains — how do you pay for it? What other services do you cut? What taxes or fees do you raise? This is why it’s easier to be a blogger than a council person, especially around budget time.

They never put selective tax incentives, breaks, etc, on those pie charts.

To elaborate…

Let’s say you have $2 million in revenues, that is collected evenly, equally, fairly (in theory anyways). Then you proceed to give someone, like say, Proctor Hospital, a $500,000 tax break. Only Proctor gets this break. Joe retailer doesn’t get it. Mr. start up industry doesn’t get it. Just Proctor get’s it. So.. now your revenues plunge to $1.5 million. In theory, so the argument goes, you might get back some of that revenue via different sources.. like say… sales tax. So… lets add back in another $250,000 in magical sales tax revenues, generated by promoting the other tax break. Overall revenues would still be lower at $1,750,000.

No doubt they included the magical sales tax revenues in their pie chart and their budget. Shouldn’t they include the inequitable tax breaks they hand out as well, in the expense column?

Why do the expenditures only add up to 95%?

Don’t forget, certain employees also get a cost of living adjustment. Ummm, can I get that too?